After a decade of data on the entire GB retail market, we delve into the transformation of two comparable seaside towns: Margate and Ramsgate.

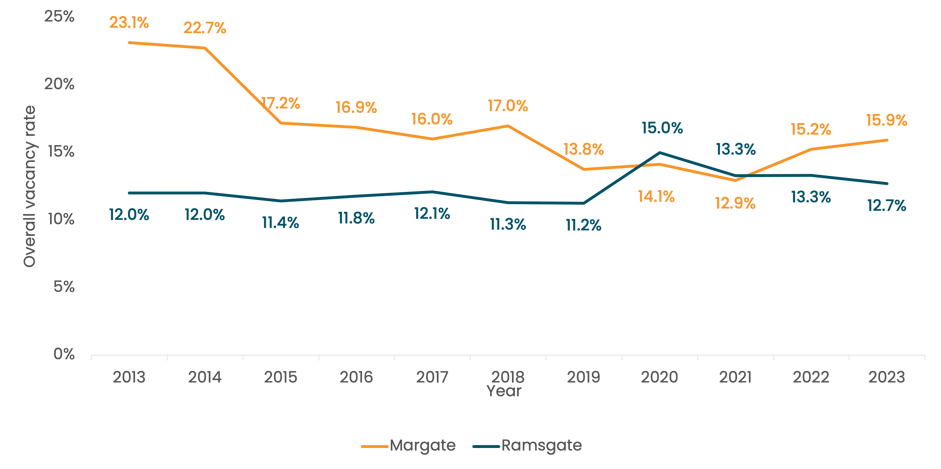

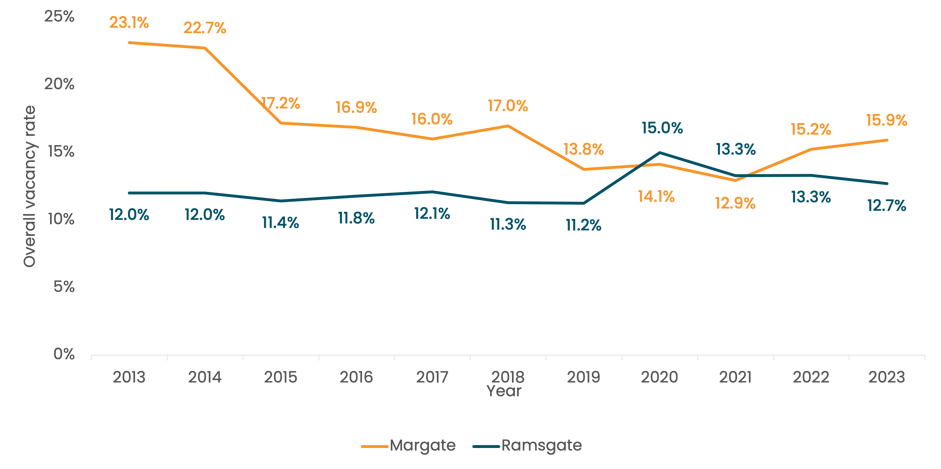

In 2012, Margate won £100,000 as part of a government-funded effort to revive Britain's declining high streets. From this, the 'Margate Town Team’ was formed with the objective of suggesting innovative ways of bringing people back to the high street. This was a catalyst for success in lowering vacancy rates within their town. However, recent years have seen a resurgence, with the current rate at 15.9%, emphasising the need for sustained efforts.

By way of comparison, Ramsgate's vacancy rates has remained comparatively stable over the years, emphasising Margate's ongoing challenge to avoid a recurrence of past struggles.

Vacancy rates

Margate was especially adversely affected by the financial crisis, experiencing many shop closures during the height of the recession. As of 2013, Margate town centre still had an overall vacancy rate of 23.1%, making it one of the worst performing high streets in Great Britain at that time.

Meanwhile, the vacancy rate in nearby Ramsgate stood at 12.0% in 2013 – a little over half that of Margate and just below the GB high street average at that time.

Historical overall vacancy rates for Margate and Ramsgate

Figure 1: Historical overall vacancy rates for Margate and Ramsgate 2013-2023 (Source: Local Data Company)

Figure 1 shows a marked decrease in the overall vacancy rate for Margate town centre in the years following the formation of the 'Margate Town Team' in 2012 until 2019. In 2015, the vacancy rates started to fall from 22.7% to 17.2% during that year. In contrast, Ramsgate remained relatively flat between 2013 and 2019.

Despite a small rise in closures during the COVID pandemic, vacancy rates became lower in Margate than in nearby Ramsgate during both 2020 and 2021. Since then, vacancy rates have risen again in Margate over the last two years, whereas Ramsgate has remained stable, suggesting that there is still work to be done in Margate.

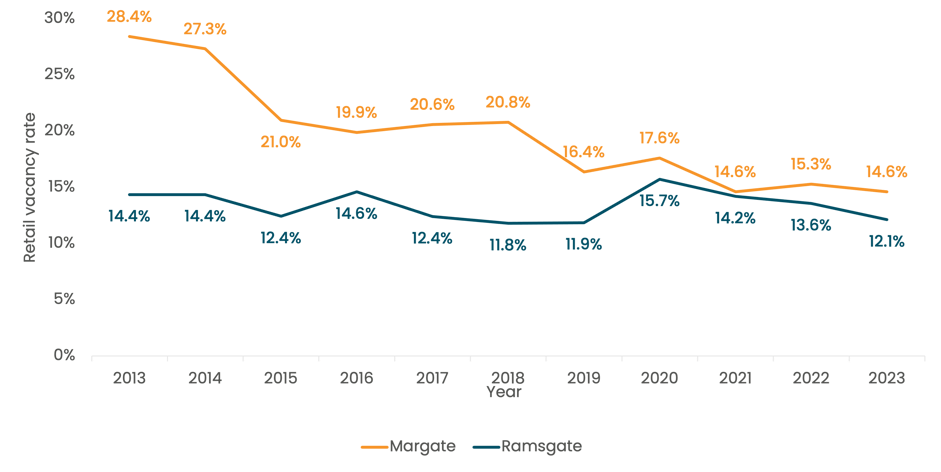

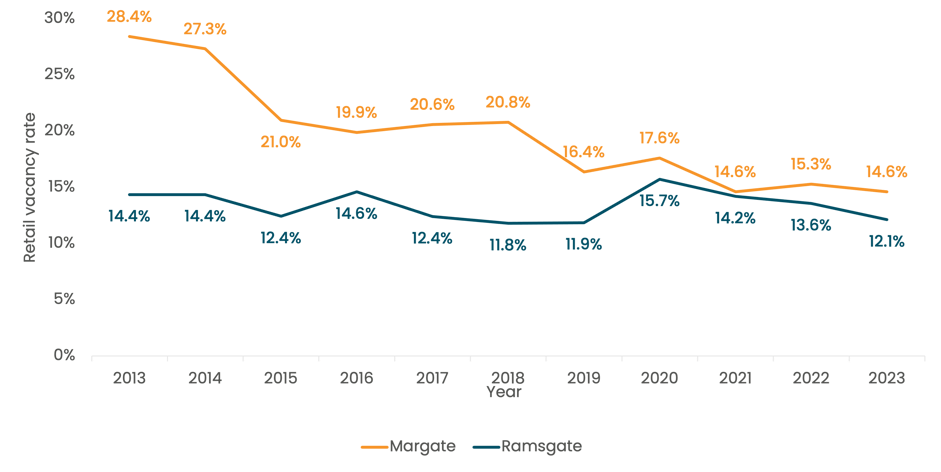

Historical retail vacancy rates for Margate and Ramsgate

Figure 2: Historical retail vacancy rates for Margate and Ramsgate 2013-2023 (Source: Local Data Company)

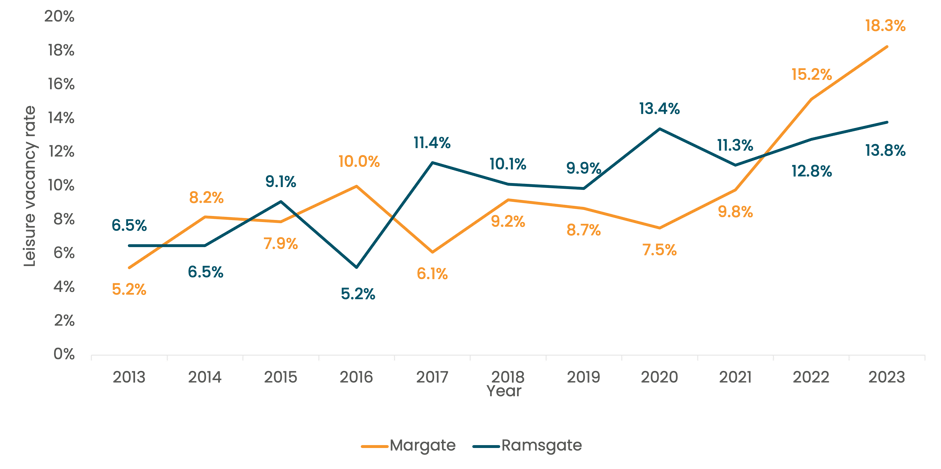

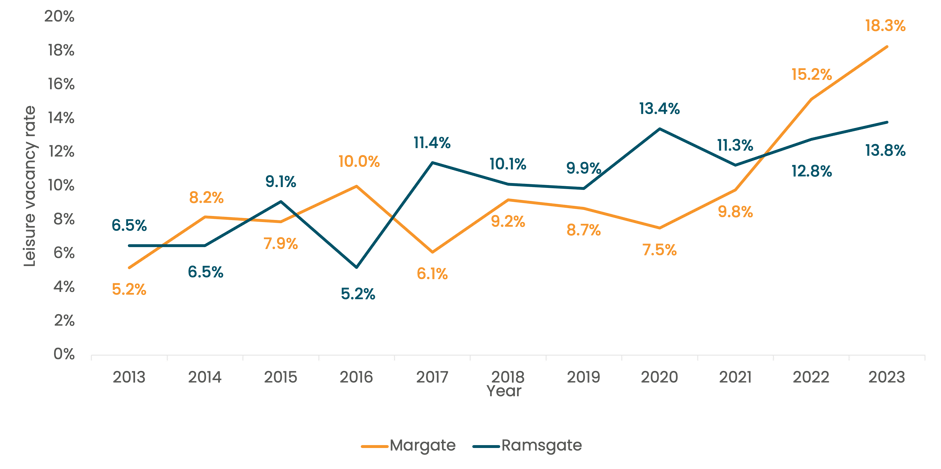

Historical leisure vacancy rates for Margate and Ramsgate

Figure 3: Historical leisure vacancy rates for Margate and Ramsgate 2013-2023 (Source: Local Data Company)

Figures 2 and 3 show a contrast in the trends behind the separate retail vacancy rate and leisure vacancy rate in Margate, from which the overall vacancy rate is derived.

Similar to the overall vacancy rate, Margate's retail vacancy rate was almost double that of Ramsgate in 2013. Figure 2 shows that Margate then embarked on a downward trend until 2021 and remain at the same level today. Meanwhile, the retail vacancy rate was more adversely affected by COVID in Ramsgate but has dropped steadily since the height of the pandemic, to the much lower 12.1% we see today.

However, leisure vacancy in both Margate and Ramsgate have witnessed many more fluctuations than retail vacancy during the last 10 years. Margate's leisure vacancy rate stood at just 5.2% in 2013, which was lower than both that of Ramsgate and GB (7.5%) at that time. Figure 3 shows that in Margates number of unoccupied until rose in 2016 but then dropped lower than that of Ramsgate for the next five years.

Unfortunately, the last three years has brought about an unexpected rise in the leisure vacancy rate in Margate town centre. Suggesting an oversupply in leisure with fewer people visiting such facilities in Margate town centre - due to a higher tendency to work from home following the COVID pandemic.

Business Types

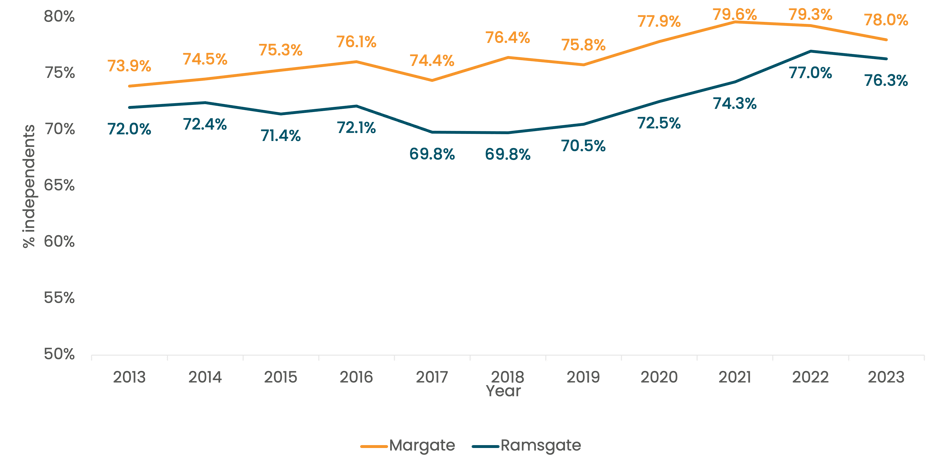

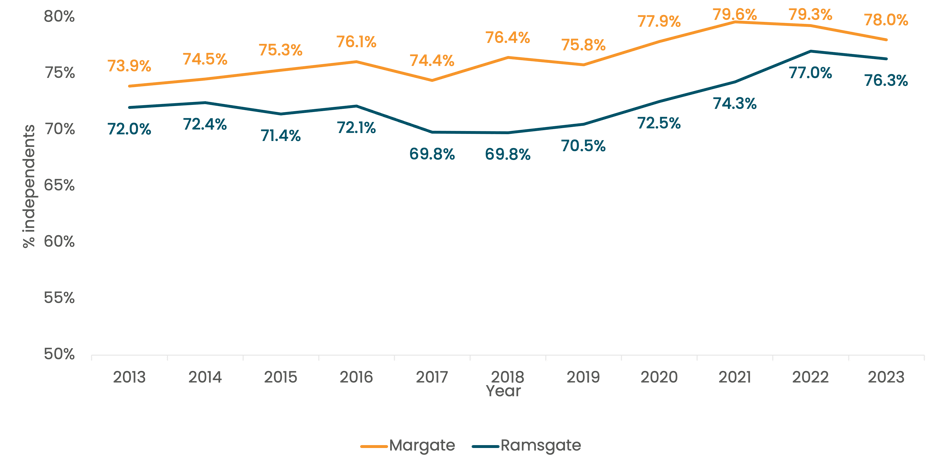

Historical proportion of independents for Margate and Ramsgate

Figure 4: Historical proportion of independent businesses in Margate and Ramsgate 2013-2023

Whilst the number of multiples has remained fairly constant in Margate during the last decade, the number of independents has increased from 153 in 2013 to a peak of 195 in 2022. A high proportion of independent businesses is common among more affluent areas and tourist destinations.

The proportion of independent businesses has remained higher in Margate than in Ramsgate throughout the last 10 years, but both towns have seen a general upward trend.

There was a year-on-year increase in the proportion of independent businesses in Margate for four consecutive years between 2013 and 2016, prompted by the 'Pop-Up Margate' incentive, followed by another increase between 2019 and 2021.

Ramsgate followed a similar trajectory, experiencing a year-on-year increase in independent businesses. However, both towns saw a decline in the proportion of independents in the past year, attributed to higher operating costs impacting smaller businesses.

Going forward

With Margate (£6.3m) and Ramsgate (£19.8m) both receiving further funding via 'Levelling Up' for long-term regeneration and growth projects in 2021, both are well positioned to stand up to the current challenges.

Whilst previous regeneration projects in Margate have been an undoubted success, the most immediate concern will be to continue to address the recent increase in leisure vacancy rates, caused by the apparent oversupply of such businesses leading up to the COVID pandemic as well as more recent closures due to an increase in operating costs.

901

901

901

901