With a decade of proprietary data on the entire GB retail market, we have been able to analyse the changing performance of the country’s shopping centres. Our findings reveal significant shifts in the shopping centre landscape, driven by changing consumer behaviour and an evolving retail industry.

Vacancy rates

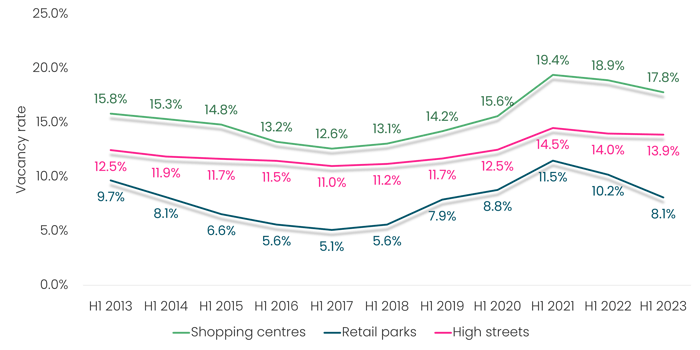

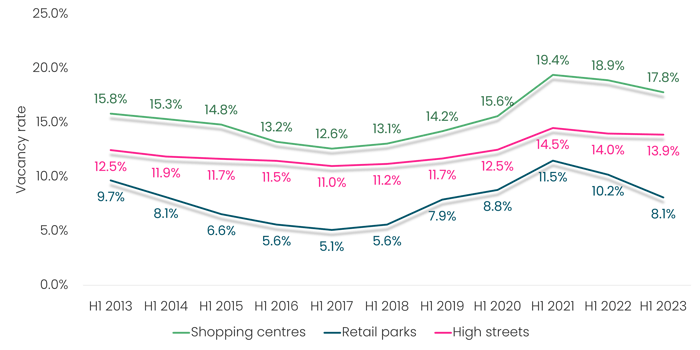

Historically, shopping centres have experience higher vacancy rates compared to high streets and retail parks. In 2013, shopping centre vacancy rates were 15.8%. By the end of 2022, these rates had increased to 17.8%, representing a rise of 2.0%. During the same period, high streets saw a 1.4% increase, while retail parks experienced a decrease of -1.6%.

Figure 1: Vacancy rate by location type, H1 2013-H1 2023 (Source: Local Data Company)

Figure 1: Vacancy rate by location type, H1 2013-H1 2023 (Source: Local Data Company)

Between 2016 and 2019, shopping centre vacancy looked like it would fall in line with high street vacancy, but the 2020 pandemic hit shopping centres harder than any other location type, with vacancies reaching a peak of 19.4% in 2021. Shopping centres were particularly vulnerable due to fashion and clothing brand closures and CVAs. The departures of department store anchors like BHS and Debenhams, along with closures from other major retailers including Marks & Spencer, House of Fraser, and John Lewis, had a significant impact.

Category mix

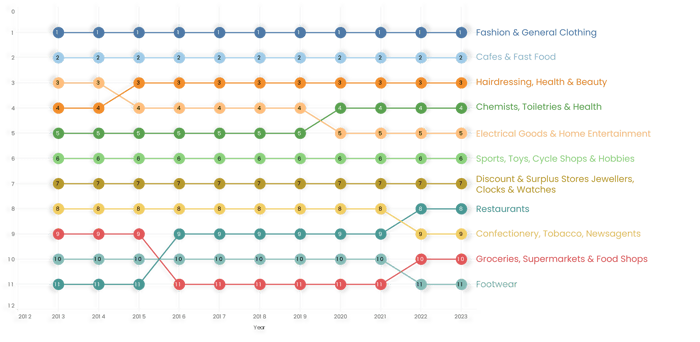

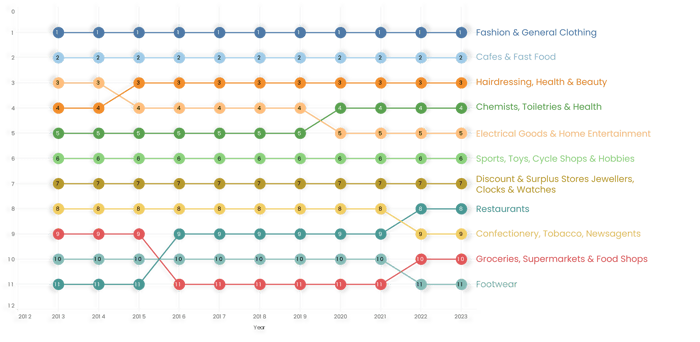

Shifts in category mix over the decade reflect changing consumer preferences, and demonstrate the evolving role of shopping centres as lifestyle and entertainment destinations.

Despite numerous CVAs and administrations, the fashion & general clothing category remained the biggest shopping centre occupier in terms of store numbers. Cafés & fast food held the second position throughout the decade, with classic fast-food brands such as McDonald's, KFC, Burger King, and coffee shops like Starbucks, Costa, and Caffé Nero remaining popular to this day.

Figure 2: Changes in category ranking across GB shopping centres, 2013-2023 (Source: Local Data Company)

Figure 2: Changes in category ranking across GB shopping centres, 2013-2023 (Source: Local Data Company)

Electrical goods and home entertainment fell from third to fifth place over the decade. It was overtaken by the hairdressing, health & beauty and chemists, toiletries, and health categories due to a surge in consumer spending on beauty and personal grooming.

Notably, restaurants rose from outside the top 10 categories in 2013 to 8th place in 2023. Many shopping centres expanded their leisure offerings in this time, focusing on casual dining brands such as Nando's, Wagamama, and Pizza Express, all of which experienced significant growth.

Top 20 shopping centre occupiers

Interestingly, the data revealed a notable degree of stability in shopping centre occupancy: 60% of the top shopping centre brands in 2013 have retained their positions in 2023’s top 20.

While shopping centres are often associated with fashion retail, only Claire's and New Look managed to secure a place in the top 20 list in terms of store numbers, indicating a shift in consumer preferences over the decade.

The majority of the top brands cater to convenience and necessity, with card shops, toiletries, and food-to-go concepts well-represented in the list. Brands like Game and Clarks faced store closures, causing their exclusion from the top 20. Phones4U and Carphone Warehouse vanished entirely, although three phone shop brands have remained near the top.

As a reflection of evolving consumer trends and a growing appetite for budget-friendly offerings, new entrants in the top 20 in 2023 included The Works and Poundland. In line with the rising demand for ‘athleisure’ and their own global expansion efforts, JD Sports also emerged as a new addition to the top list with a substantial increase in shopping centre locations.

Figure 3: Top 20 shopping centre brands, 2013 vs. 2023 (Source: Local Data Company)

The past decade has brought a wave of change to Britain’s shopping centres. These locations have adapted to the challenges posed by a dynamic retail environment, increasingly positioning themselves as experiential destinations with strong F&B and leisure offers. This focus is likely to continue, and we expect that this location type will only welcome more innovations in the coming years.

901

901

901

901

Figure 1: Vacancy rate by location type, H1 2013-H1 2023 (Source: Local Data Company)

Figure 1: Vacancy rate by location type, H1 2013-H1 2023 (Source: Local Data Company) Figure 2: Changes in category ranking across GB shopping centres, 2013-2023 (Source: Local Data Company)

Figure 2: Changes in category ranking across GB shopping centres, 2013-2023 (Source: Local Data Company)