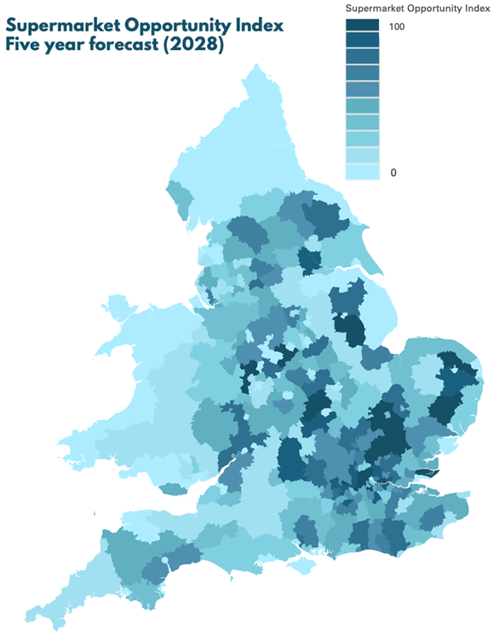

Edge Analytics’ latest population forecasts* have been matched against LDC’s rich POI data on supermarkets across the country to create our own Supermarket Opportunity Index, a tool to identify areas of undersupply— representing future opportunity— in grocery retail.

Our analysis spans all grocery retail types, from local independents to national retail chains. It also considers market share, using a quality ranking to evaluate the reach and impact of the largest supermarket brands, ensuring that the Supermarket Opportunity Index is comprehensive, accurate and representative of the market.

The map below shows the level of supermarket opportunity across England and Wales’ Local Authority Districts**. The scale from 0 to 100 represents a measure of density, where a higher score indicates a lower density of supermarkets in comparison to the projected population size for 2028— a score of 100 indicates the greatest opportunity for grocery retailers.

Figure 1: Supermarket Opportunity Index showing future 5-year population growth against grocery demand by Local Authority District (Source: Edge Analytics/Local Data Company)

Slough ranks fifth overall in the Index, indicating significant potential for supermarket growth in the area. Recent developments, including the opening of an Aldi in October 2023 and the Lidl branch established in 2022, highlight Slough’s ongoing appeal for grocery retailers.

Several boroughs in mid- and outer London also score high on the Index, thanks to strong housing development pipelines. Aldi has already announced plans to nearly double its store count within the M25 to meet predicted population growth in areas such as Newham.

South Cambridgeshire comes in third, reflecting substantial infrastructure changes and an anticipated surge in population count. Lidl has recognised this potential, revealing plans to target thirteen additional locations in Cambridgeshire, more than tripling the brand’s current store count.

On the other end of the Index, certain locations represent less opportunity for new supermarket openings. Cities such as Hull, Middlesborough, Blackpool and Sunderland have seen closures from Lidl as the brand repositions itself in these markets.

The Supermarket Opportunity Index highlights regions of untapped potential, but it also underscores the need for careful strategic planning and location prioritisation to weather changes in the market and anticipate population growth. As grocery retailers expand their reach amid the cost-of-living challenges, identifying smaller markets that can still support new stores requires a precise approach to location strategy. Prioritising the right locations has become ever more critical to ensure the best return on investment in the evolving British grocery sector.

*Edge Analytics’ five-year dwelling-led population forecast, based on the recent Census. The forecasts model the future population of England and Wales at the LSOA (Lower Super Output Area) level.

**Data has been summarised at Local Authority District (LAD) level using the boundaries released in April 2023.

901

901

901

901