In our final chapter in our Then & Now series chronicling the change in retail and leisure over the past decade our focus turns to high street. LDC has reviewed how the make-up of GB High Streets has changed over ten years, looking specifically at vacancy rates, category mix and brands. To do this we focused on the Top 650 town centres.

Vacancy rates

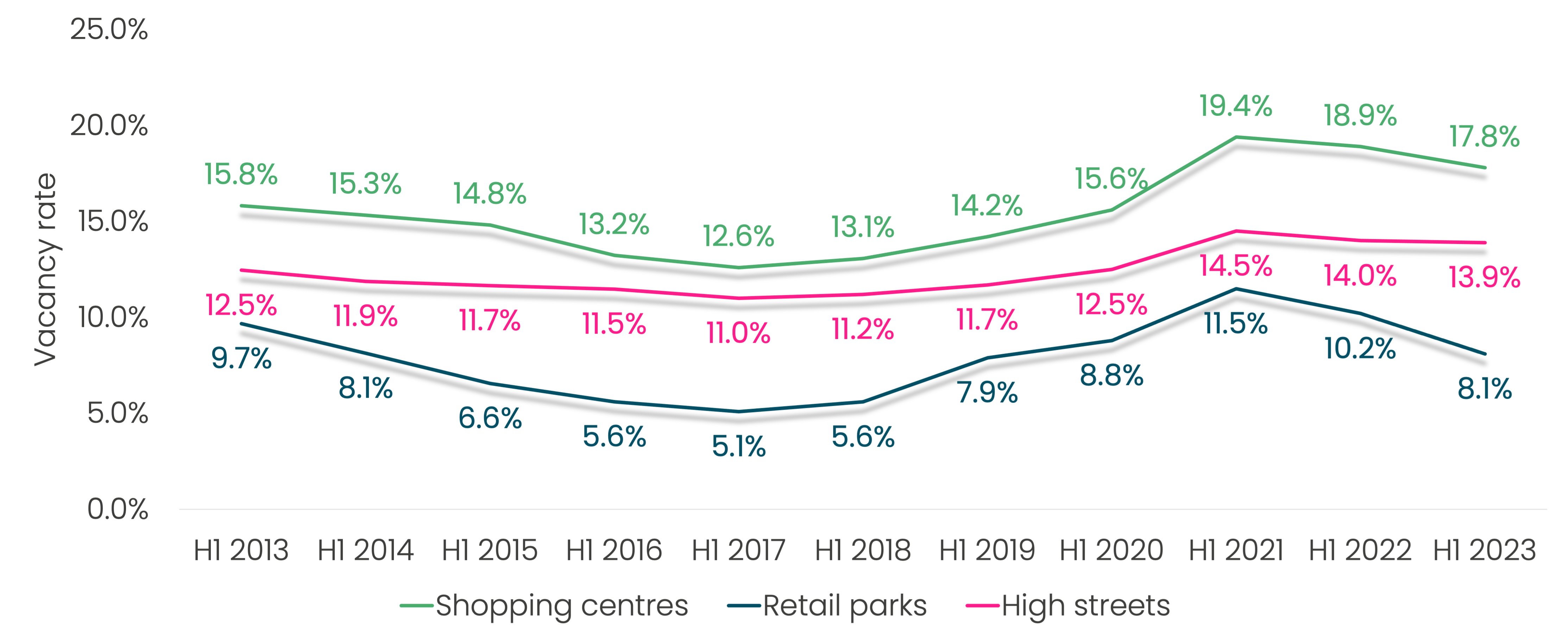

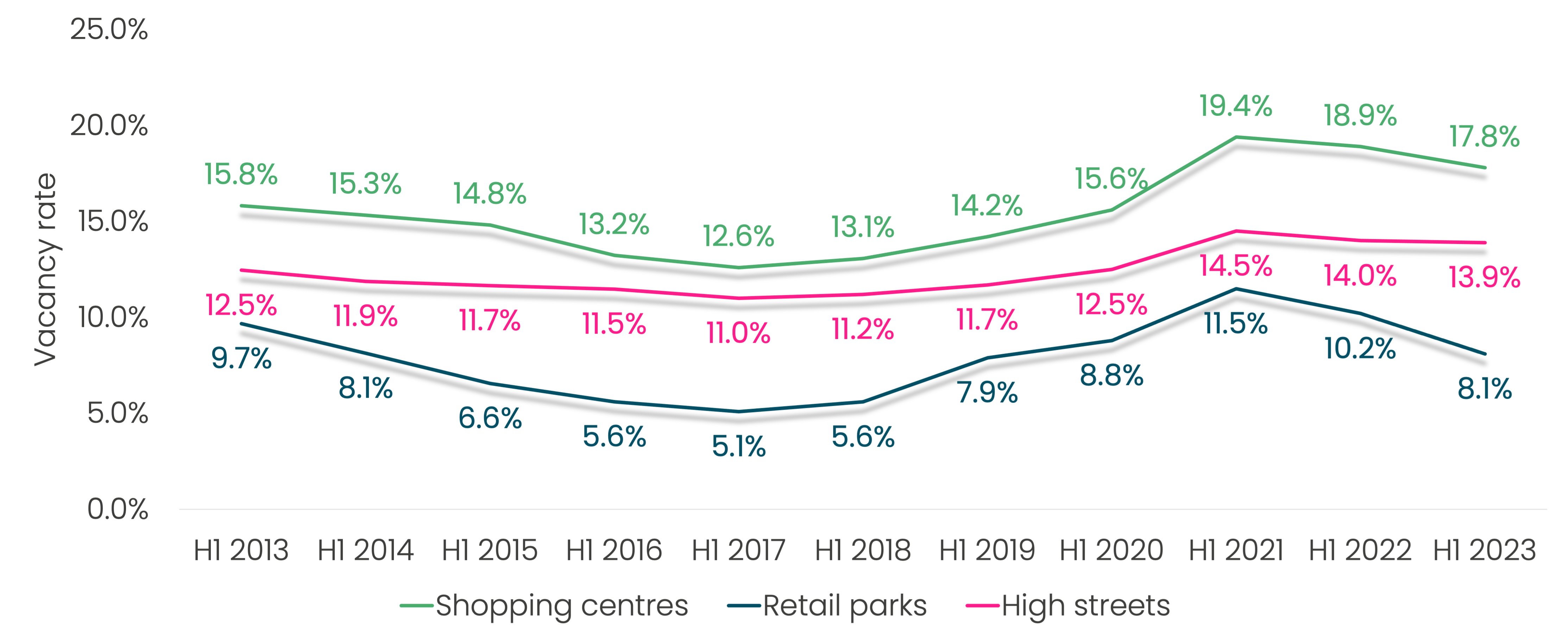

Across the past 10 years, high streets have historically had vacancy rates which sit in between the shopping centre and retail park vacancy rates. High street vacancy rates sat at 13.9% at the end of H1 2023, up 1.4% when compared to H1 2013. During the pandemic, high street vacancy rates rose to 14.5% the highest level across the last 10 years off the back of administrations and closures due to the various lockdowns and disruption to high street retail shops. Vacancy rates are yet to drop to pre-pandemic levels, with vacancy rates still up 2.2% when compared to H1 2019.

Vacancy rate by location type

Figure 1: : Historical vacancy rate by location type across GB, H1 2013- H1 2023 (Source: Local Data Company)

However, High streets were the least affected location type by covid-19 pandemic, rising just +2.8%, compared to Shopping Centres (+5.2%) and Retail Parks (+3.6%) when compared to H1 2019. This could be for a multitude of reasons including the higher mix of independents located in High Street locations, with this business type being more resilient during the pandemic, and the fact that Shopping Centre locations were more exposed to the highly publicised closures of both Fashion shops and Department stores, such as Debenhams and Arcadia Group.

Category mix

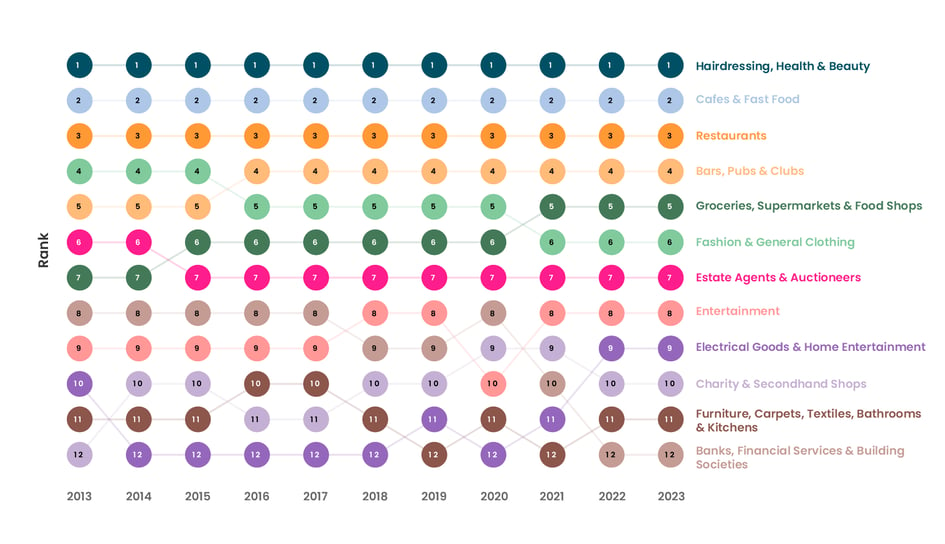

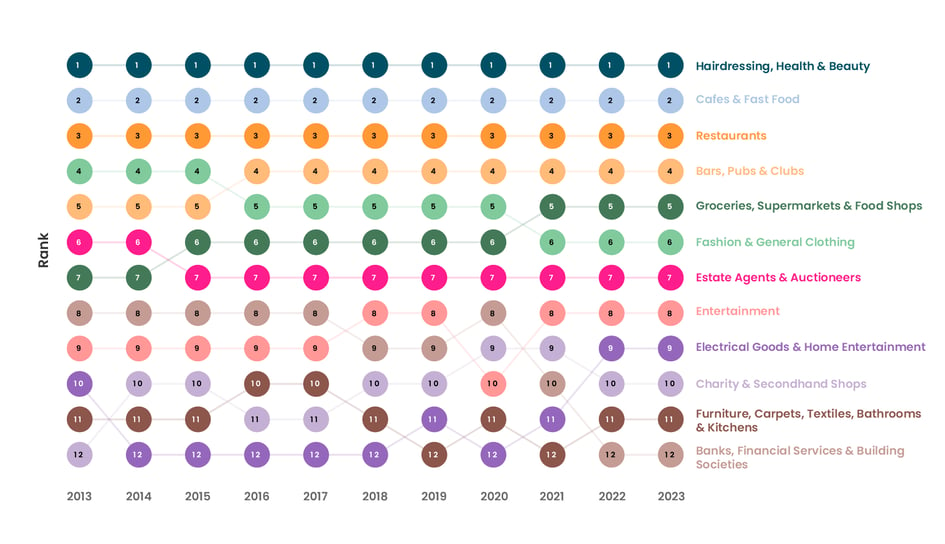

LDC analysed the Top 650 high streets across GB between 2013 and 2023 to see how the category mix of these locations has changed over time. Long term changes in category mix are indicative of changing consumer demands and can highlight how the role of the High Street may be evolving over time.

One of the prevailing trends over the past 10 years is one of stability amongst the top categories. Hairdressing, Health & Beauty maintained its position as the largest category in terms of store numbers across every year. Cafes & Fast Food and Restaurants also held their positions as second and third respectively throughout the decade, with the growth of delivery channels, fast casual and coffee culture operators continued to expand across GB.

High street top 10 category ranking 2013-2023

Figure 2: Changes in category ranking across GB high streets, 2013-2023 (Source: Local Data Company)

the growth of online shopping which accounts for 27.3% of all retail sales within the category compared to 10.3% in 2013 (Source: ONS). Occupiers have continuously downsized their estates, as well as the loss of major brands such as Topshop over the 10-year periods.

Groceries, Supermarkets & Food Shops moved from seventh to fifth place over the decade, reflecting the changing consumer preferences and the growing demand for convenience. The major supermarket brands have increased their presence of convenience style stores on high streets over the past ten years, while the discounters have continued to take market share from the Big 4 supermarkets with Aldi opening their 1,000th store in 2023.

Notably, the biggest decline was seen in Banks, Financial Services & Building Societies which fell from eighth place in 2013 to outside of the top 10 in 2023. LDC has previously reported on the closure of high street banks and how this is impacting many town centres. These closures are expected to continue over the coming years as more customers switch to online banking platforms and high street banking facilities vanish from many towns. Barclays, Lloyds and Halifax have all announced further rounds of branch closures already for 2024 with this a long term trend.

Highest Growth & Declining Brands

LDC reviewed the brands which have seen the most significant changes over the course of the last decade to identify trends within these fastest growing and declining operators.

Reviewing the brands experiencing the most substantial growth reveals a notable growth in various fast-food brands such as German Doner Kebab, Pepe’s Piri Piri, Taco Bell, Fireaway Pizza, Domino’s Pizza and Papa John’s. Furthermore, coffee shop brands such as Pret A Manger, Costa and Gail’s also make an appearance in the highest growth brands, reflecting the changing consumer behaviour of the past decade with a greater focus on convenience and proximity to commuter areas as well as opening locations across the country away from their London hubs.

Top 20 Growth Brands 2013-2023 - by no of stores | Top 20 Declining Brands 2013-2023 - by no of stores, excluding complete closures

Figure 3: Highest growth and decline high street brands, 2013 vs. 2023 (Source: Local Data Company)

On review of the brands with the biggest decline across the last 10 years, it will come with little surprise that a vast number of Banks make up the top 20 brands. High street banks have seen huge decline and continue to close branches as discussed earlier in this blog. Other brands which have seen decline include longstanding fixtures of the high street such as Argos, Boots and Post Office, who have all made changes to their store portfolios in recent years with a focus on consolidation due closing more remote locations with lower levels of footfall traffic. The other major category in the fastest declining group are bookmakers, with this being another category that has been impacted by the growth in online and digital apps, as well as changes in legislation from the FOTB (Fixed Odds Terminal Betting) ruling in 2018 that saw major brands close sites due to the drop in profitability.

The high street has long been central to British retail, and this is evident over the past decade. The accessibility and familiarity to its residents has been pivotal for high streets in positioning themselves as a stable location type. We continue to see the importance of physical retail, with the next decade likely to see more change and re-invention across many town centres with our data being key in highlighting these trends.

901

901

901

901