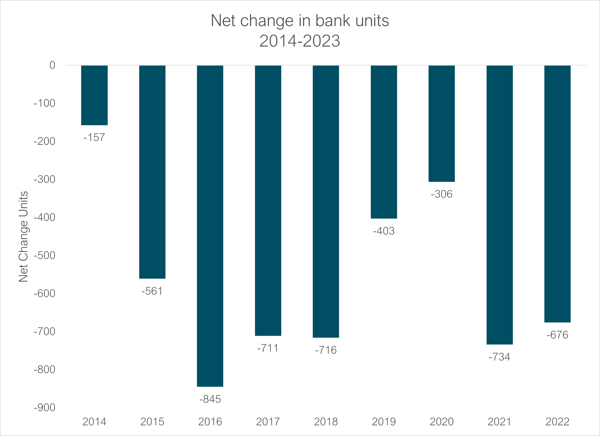

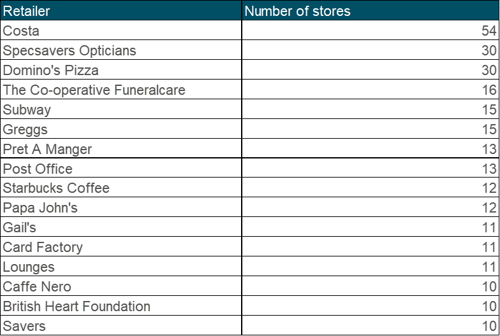

Our recent analyses have highlighted the dwindling numbers of banks across the country, although the number of GB bank branches has been decreasing year-on-year since 2014. Over 5,000 bank branches have been closed in this time, as the prevalence of online banking continues and a number of mergers between major banks has led to reductions in branch numbers.

Figure 1: Net change in bank units in GB, 2014-2022 (Source: Local Data Company)

According to Which?, over 500 branches are set to close in 2023, with more than 200 of these closures already complete. Even as demand for in-person services remains, former bank sites can be challenging to fill. In this article, we review the current status of these sites and how they are being reoccupied.

The scale of closures

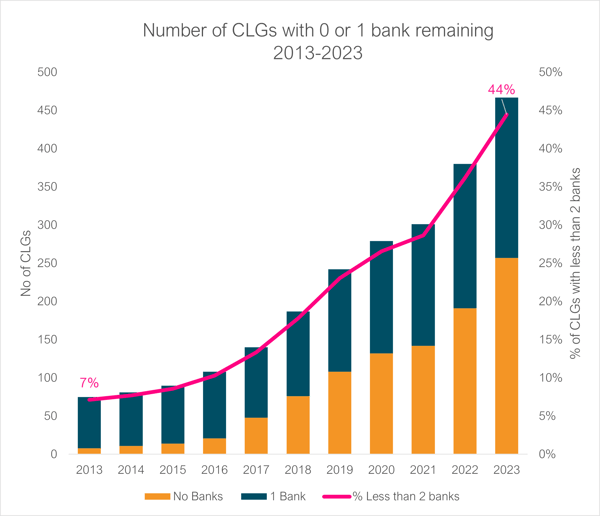

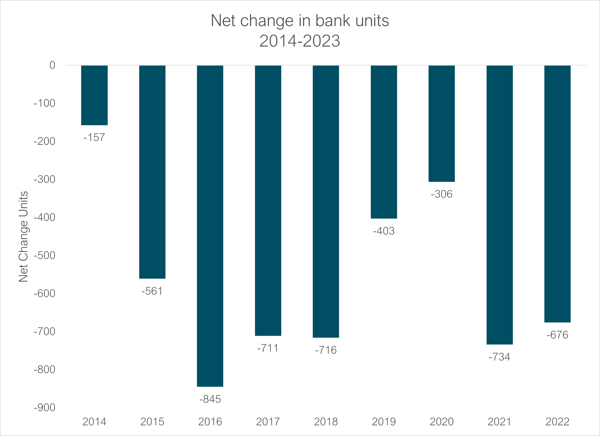

LDC reviewed 1,050 CLGs of over 50 units each, to assess how many of these were left with either 0 or 1 bank branch between 2013 and 2023.

Figure 2: Number of CLGs with 0 or 1 bank branch remaining, 2013-2023 (Source: Local Data Company)

In 2013, only 8 CLGs (7% of the sample) had no banks, with a further 67 having just one. At the time of this analysis in 2023, 257 CLGs have no remaining banks, while a further 210 have one branch— this represents a total of over 44% of CLGs in the analysis with severely limited access to a dedicated local bank.

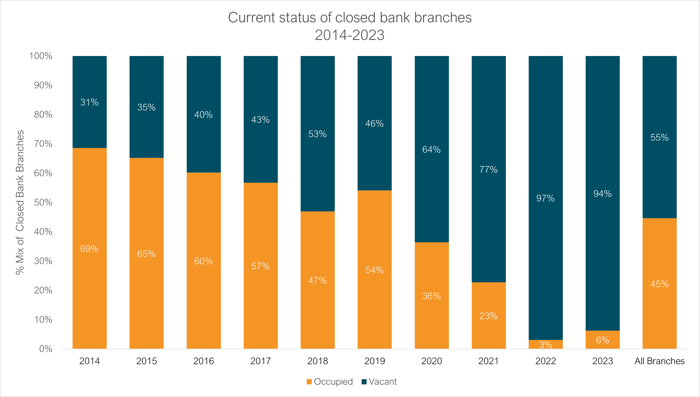

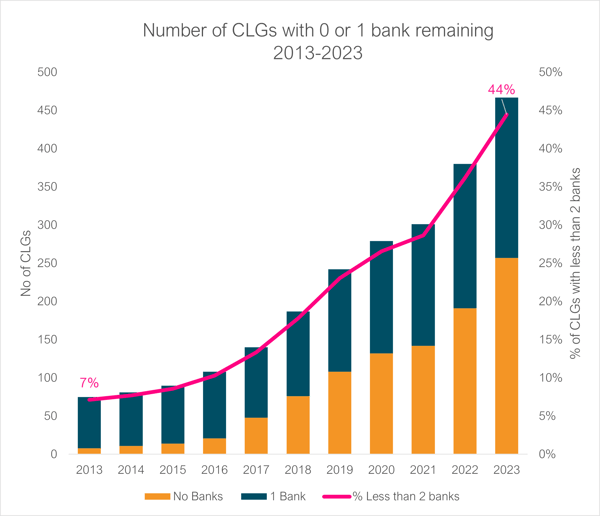

This chart shows the current occupancy status of bank branches which closed each year between 2014 and 2023. Of the branches which closed in 2014, 68.7% are now occupied by a new tenant, although the remaining 31.3% remain vacant to this day. The percentage of branches occupied by a new tenant gradually reduces year on year; only 22.7% of 2021 bank closures are occupied today.

Figure 3: Current occupancy status of closed GB bank branches by year of closure, 2014-2023 (Source: Local Data Company)

This indicates that closed bank branches can take some time to fill. On average, bank branches stand vacant for just over 2 years (852 days) before a new occupier is live and trading from the site. Overall, 44.6% of all closed bank branches have reopened under a new occupier, while 55.4% remain vacant.

Why are bank branches especially difficult to fill?

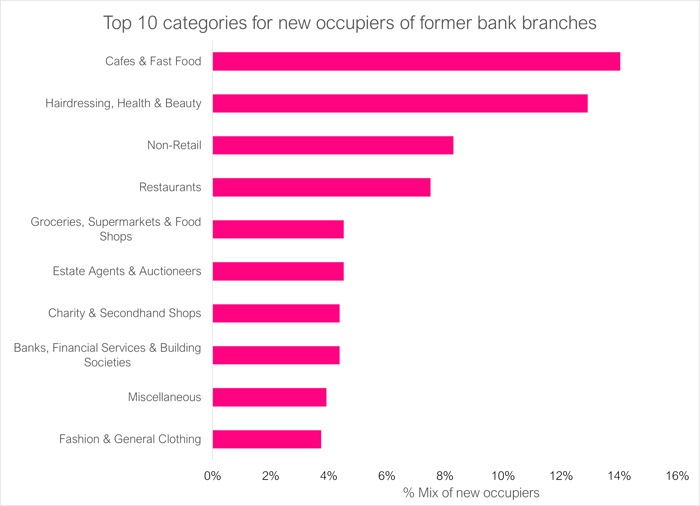

As a result of their larger size and building design, some older bank buildings have proven more challenging to let than regular retail units. To provide insight into potential target brands and categories for councils and landlords, we analysed the new occupiers of ex-bank branches.

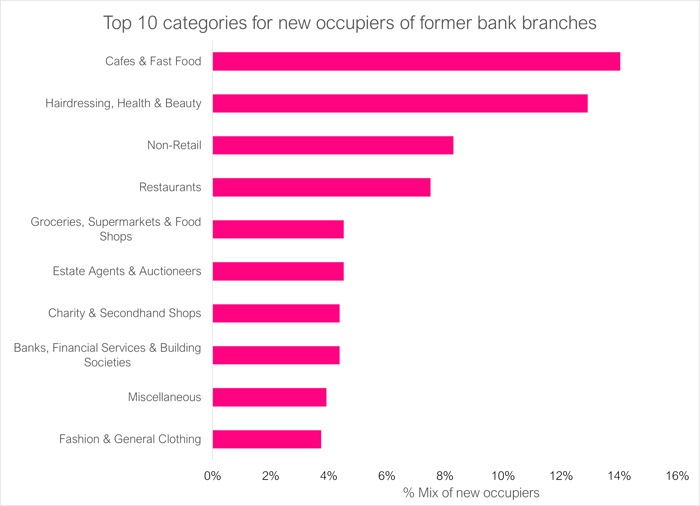

This chart shows the top 10 categories which have taken on former bank sites. Cafés & fast food was the top category, with restaurants also featuring in the list. These types of business may be better able to make use of older, grander spaces in terms of size and design, with comparatively minimal aesthetic and structural changes needed to make the space fit for purpose.

Figure 4: Top 10 categories for new occupiers of former GB bank branches (Source: Local Data Company)

65% of new occupiers for these units are independent retailers. Given that some former bank buildings have been vacant for a considerable amount of time, independent occupiers may be able to secure favourable rental terms on these units.

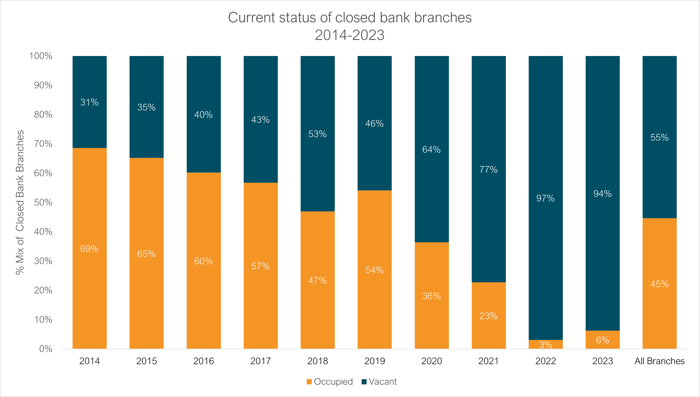

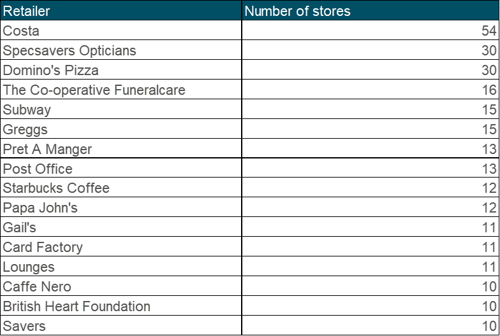

We have identified the top 15 brands occupying former bank sites, with the number of branches they have each taken over. Currently occupying over 54 ex-bank sites, Costa has been the most prolific occupier of these units so far. Others include Pret A Manger, Gails Bakery and Lounges, who have each taken on several older buildings.

Figure 5: Top occupiers of former GB bank units (Source: Local Data Company)

The future of former bank sites

Calls continue for banking hubs and other alternatives to preserve access to in-person banking services, although it is unlikely that we will see the same prevalence of high street bank branches in future.

The current nature of physical retail, with many retail estates having been consolidated as part of a multichannel approach, suggests that these larger spaces will continue to be more popular among hospitality occupiers, who can make good use of the large spaces and their more traditional design schemes. Favourable rental terms on long-term vacant units may invite more independents and unique concepts onto former bank sites in the near future.

901

901

901

901