Contact name: Lucy Stainton, Commercial Director

Organisation: The Local Data Company

Phone number: 07889591487

Email: press@localdatacompany.com

Retail market remains active in 2023 despite economic challenges

A report released today by the Local Data Company indicates high levels of activity across Britain’s retail locations in the first half of 2023, despite the ongoing economic challenges for retail businesses and consumers. The analysis, which covers the performance of the GB retail and leisure market over H1 2023, also reveals that retail parks are performing well amid the continuing cost-of-living crisis.

Retail and leisure closures across GB reached 27,504 units, representing an 11% year-on-year increase, but this was matched relatively closely by the number of openings, which reached 23,504, the second-highest recorded level of openings since H1 2014.

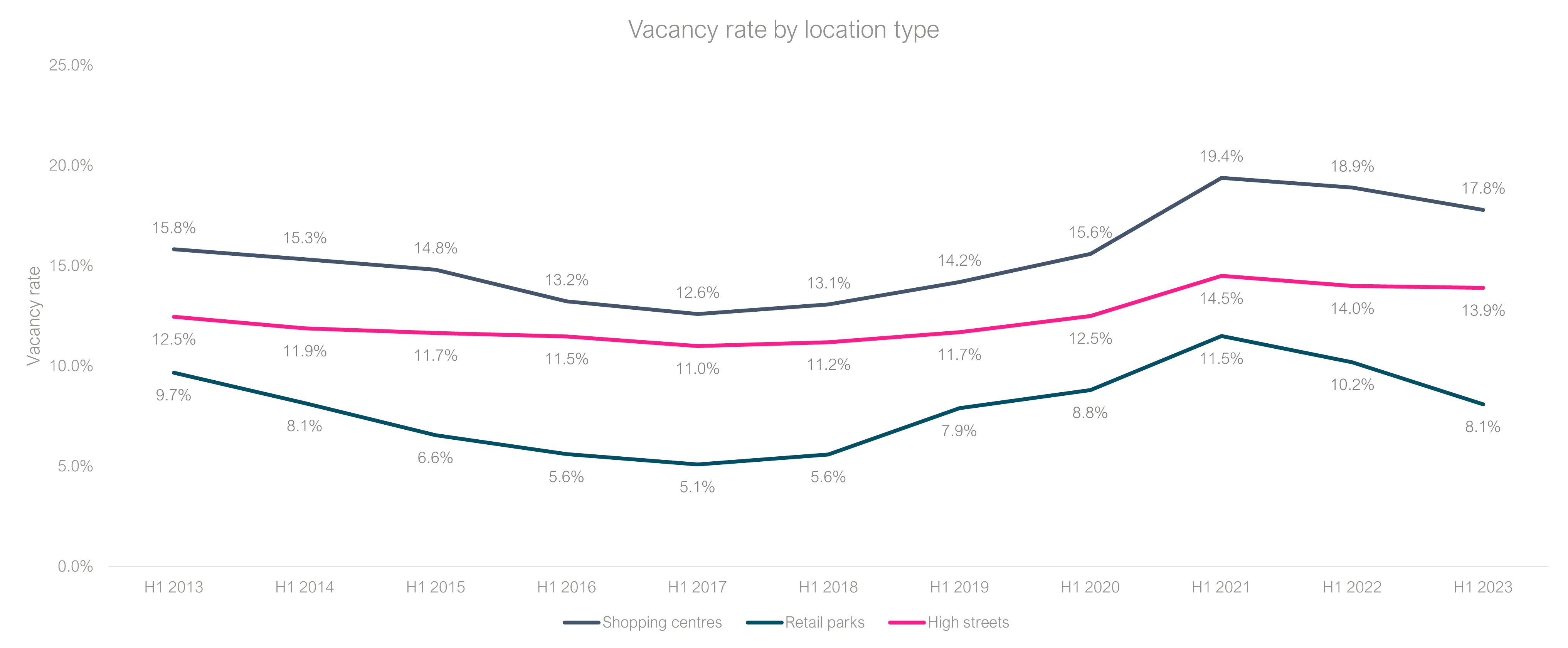

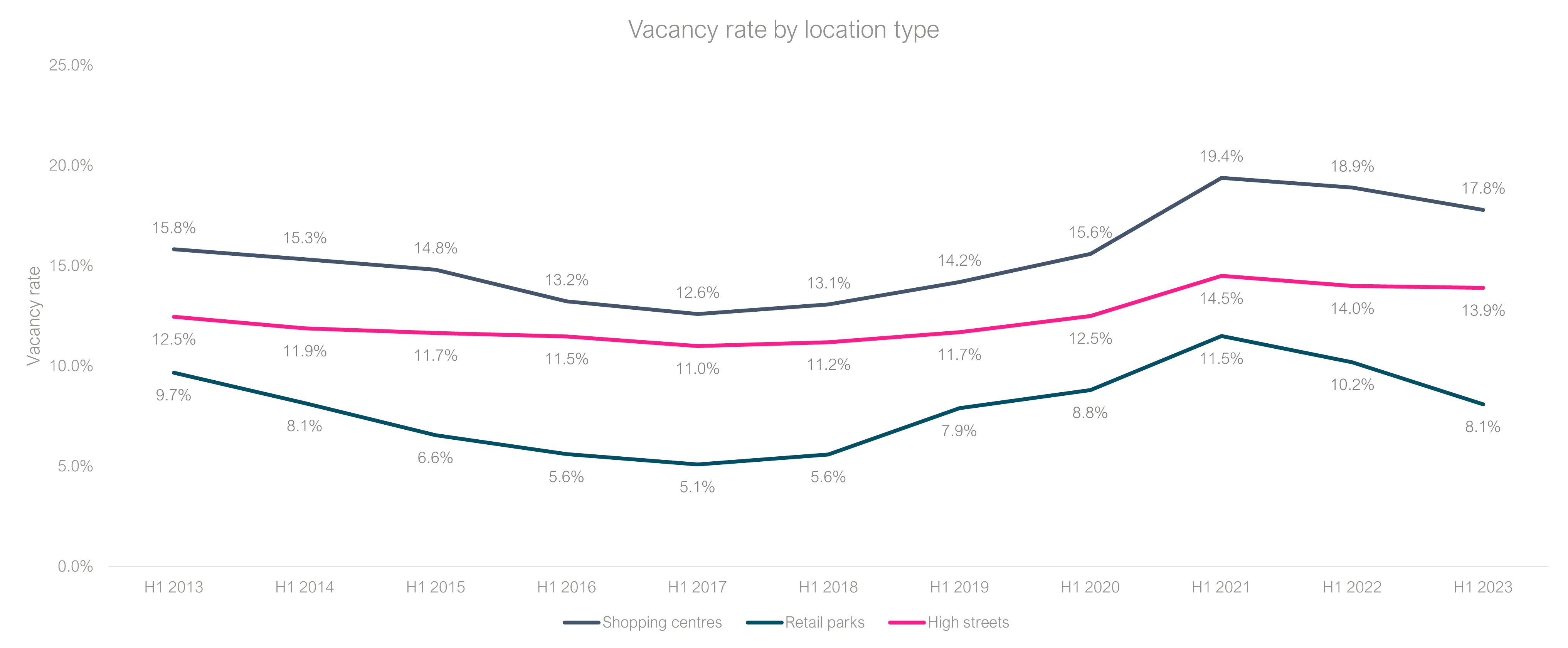

Retail parks were the only location type to record more openings than closures across the first half of the year, with a net increase of +0.6% units. Retail park vacancy reached its lowest point since H1 2019 at 8.1%, thanks to strong leasing momentum. Some of the fastest-growing retail categories of H1 2023, particularly supermarkets and health & beauty brands, increased their retail park presence significantly in this period.

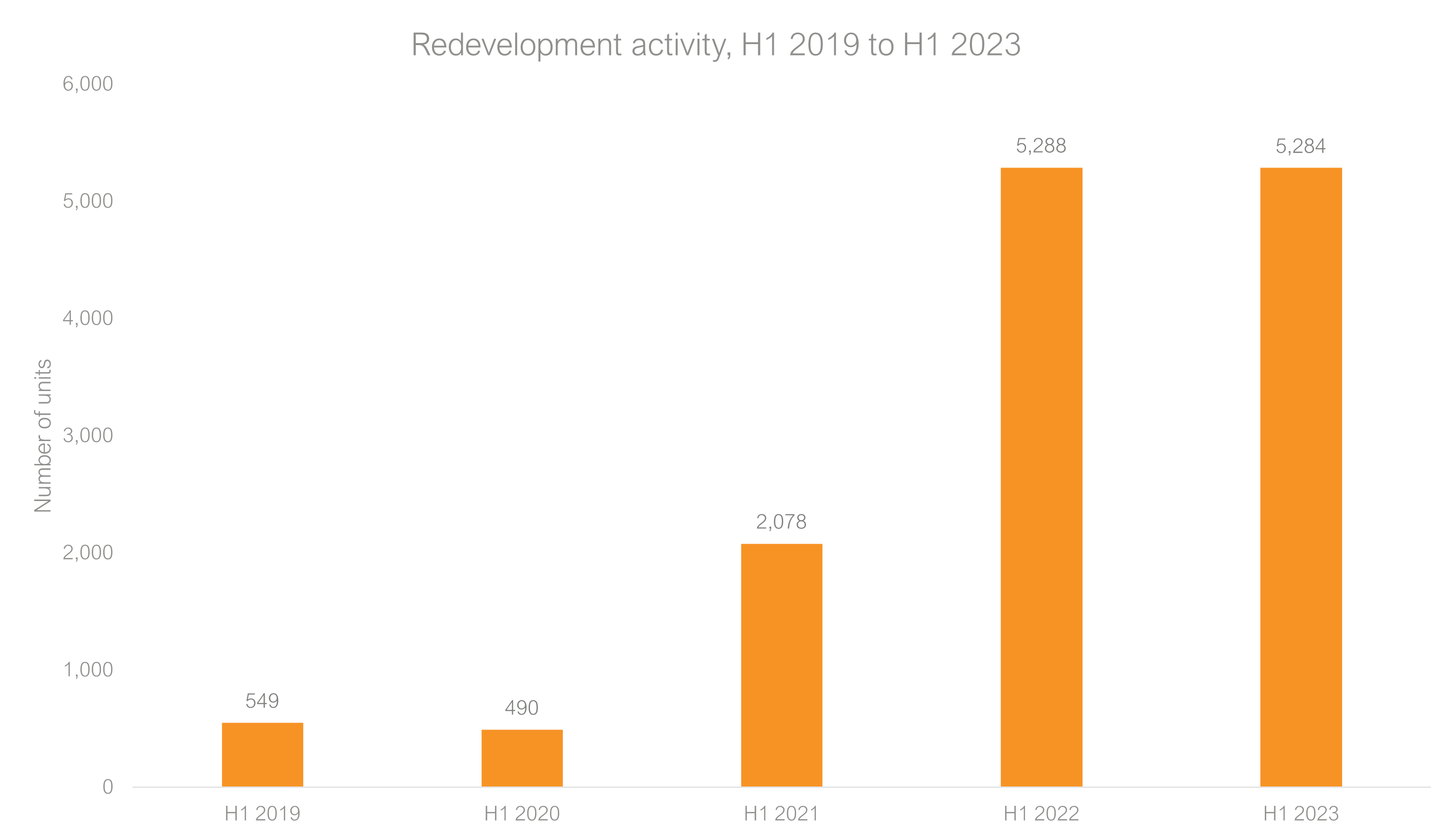

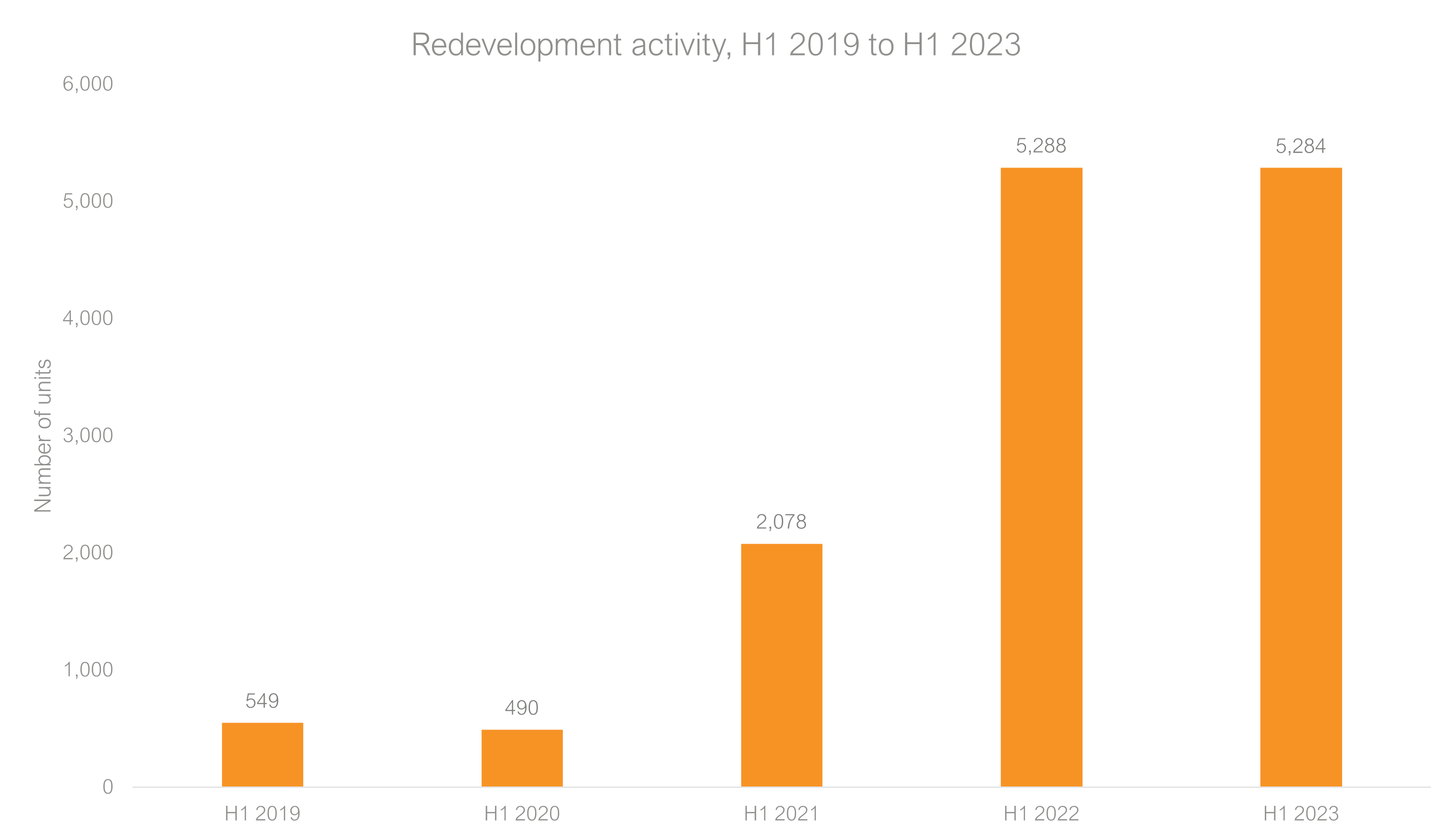

High streets have faced challenges from high levels of churn in service and comparison retail. Despite overall negative trends in high street performance, with a -0.7% net decline in units and only a -0.1% year-on-year decrease (improvement) to vacancy rate over H1 2023, there is an underlying story of redevelopment. The percentage of high street units vacant for over three years reached 5.1%, but Q2 2023 marked a halt in this increase, thanks to the ongoing redevelopment of space for non-retail uses, including residential buildings or office space.

Figure 1: Overall retail and leisure redevelopment activity across GB, H1 2019 - H1 2023 (Source: Local Data Company)

Overall, shopping centre vacancy fell from 19.4% in H1 2021 to 17.8% in H1 2023. This improvement has been driven by rebased rents, reduced CVAs and administrations, and continued efforts to redevelop and revitalise former department store units. The prime shopping centre market, in particular, has thrived, with strong leasing activity focused on brands looking for flagship stores in top locations. Across the shopping centre sector as a whole, occupiers have been consolidating their portfolios to focus on fewer, but larger and more prominent, stores.

Figure 2: Historical vacancy rate across GB by location type, H1 2013 - H1 2023 (Source: Local Data Company)

Across the market, large-format units left vacant by former department stores and Arcadia brands have continued to find new occupiers, either retailers looking to establish new flagship locations or leisure concepts with large space requirements.

Comment from Lucy Stainton, Commercial Director, Local Data Company:

"Challenges to the market in recent years have tested the staying power of even our best-loved chains. What resulted from the pandemic was a stress-tested and relatively resilient retail sector, which has helped to mitigate the effects of the latest economic headwinds. Net closures for chains have reached their lowest level since 2017, which is a testament to the recovery efforts of retailers and landlords, and some sectors of the industry— particularly retail parks, food categories and supermarkets— have continued to strengthen. That being said, the picture for our independent retail and hospitality operators in the first 6 months of this year is unfortunately less positive, with a significant swing from record growth in the first half of last year to troubling net losses in the first half of 2023. As government support lessened and the energy crisis hit, we saw this disproportionally impact sectors like hairdressers and pubs.

These changes have caused a slight uptick in overall vacancy but going forward, the focus has to be addressing long-term vacancy, curating high streets and town centres that meet the needs of their present-day catchments, and making the most of a physical store presence as a complement to online channels. We have seen some great examples of repurposing and redevelopment of former retail and leisure space, and this repurposing will need to continue to be a feature of the market in order to mitigate any emerging structural challenges and ensure the vibrancy and usability of our urban and commercial spaces for their adjacent communities and consumers."

ENDS

Notes for editors

Please contact the LDC Press Office with any additional data or interview requests at press@localdatacompany.com or 07889591487.

The full report is available to download now. Please click here to download a copy or email the Press Office.

The full report includes further detail on:

- Openings and closures

- Vacancy rates across GB by location type (high streets, retail parks and shopping centres) and region

- Redevelopment activity

- The performance of independent retail vs chain stores

- Reoccupation status of ex-department store and Arcadia units

- The fastest-growing and declining subcategories

- The outlook for 2023 and beyond, amid continuing economic pressures

Methodology

The Local Data Company visits over 5,250 towns and cities (retail centres and government-defined retail core), retail parks and shopping centres across England, Scotland and Wales. Each premises is visited, and its occupancy status recorded as occupied, vacant or demolished.

Each centre has been physically walked and each site recorded as vacant, occupied, or demolished on the day of survey. Vacant units are units which did not have a trading business on the premises on the day of survey.

Locations are updated on a 6- to 12-month cycle depending on size and churn, with both a field survey team and an office research team tracking local market changes.

‘Retail’ refers to convenience, comparison goods and service retail. ‘Leisure’ refers to entertainment venues, restaurants, bars, pubs, clubs, coffee shops and fast food outlets. ‘Independent retailers’ are businesses with fewer than five stores nationwide, and no international presence.

The GB vacancy rate analyses the top 650 town centres across England, Wales and Scotland.

About the Local Data Company

For 10 years, the Local Data Company has been compiling market-leading insight on every brick-and-mortar retail and leisure business across Great Britain’s high streets, retail parks and shopping centres.

We remain the only company to physically monitor every consumer-facing GB business, combining a dedicated field research team based all over the country with an in-office research team. New data is fed into our database every day after undergoing our rigorous quality control processes. This unique methodology allows us to offer the most accurate, real-time view of the market possible.

We are a leading voice in our sector, thanks to our team of data scientists, software developers, analysts, researchers and industry experts, who infuse years of industry experience into every product and service we offer.

For more information, please see www.localdatacompany.com.

901

901

901

901