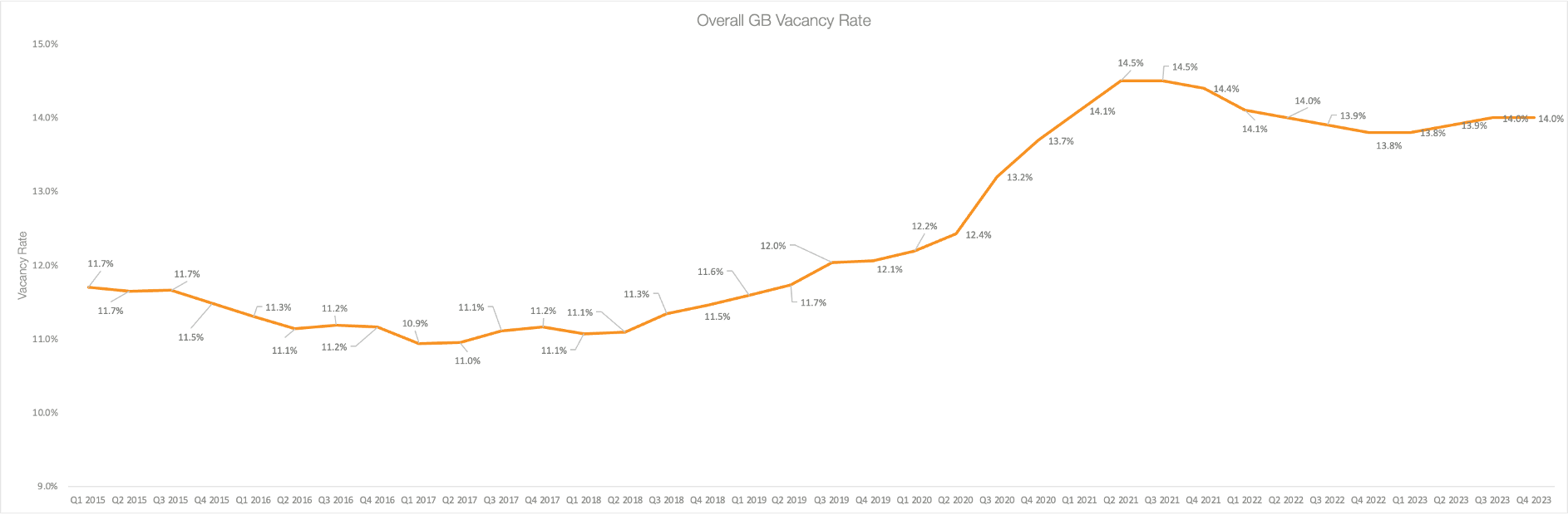

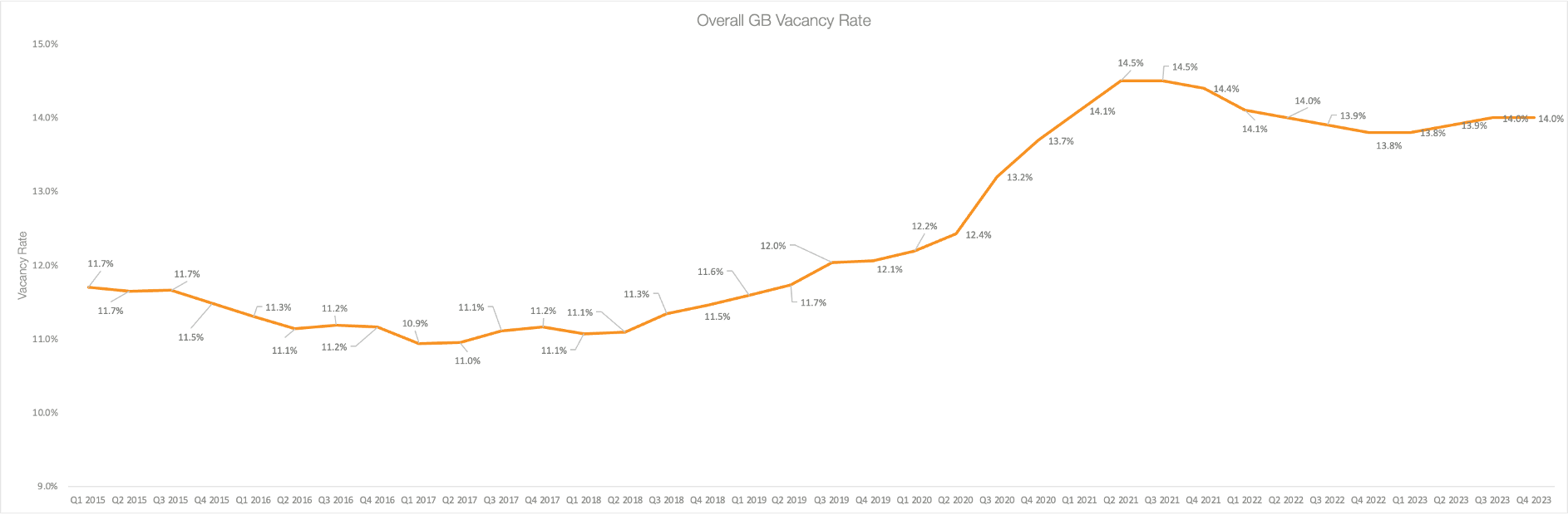

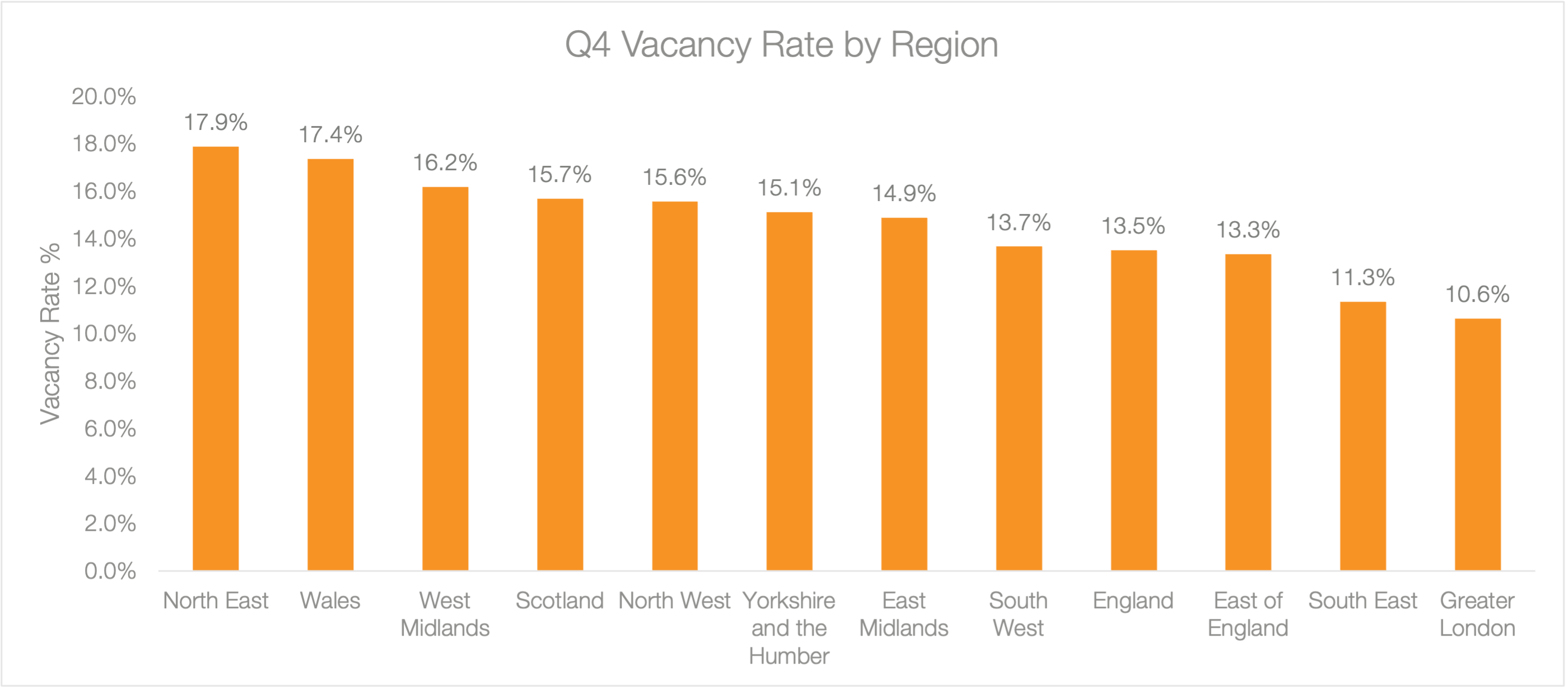

- In Q4 2023, the overall GB vacancy rate holds at 14.0%, which has remained unchanged from Q3 and 0.2 percentage points higher than the same period last year.

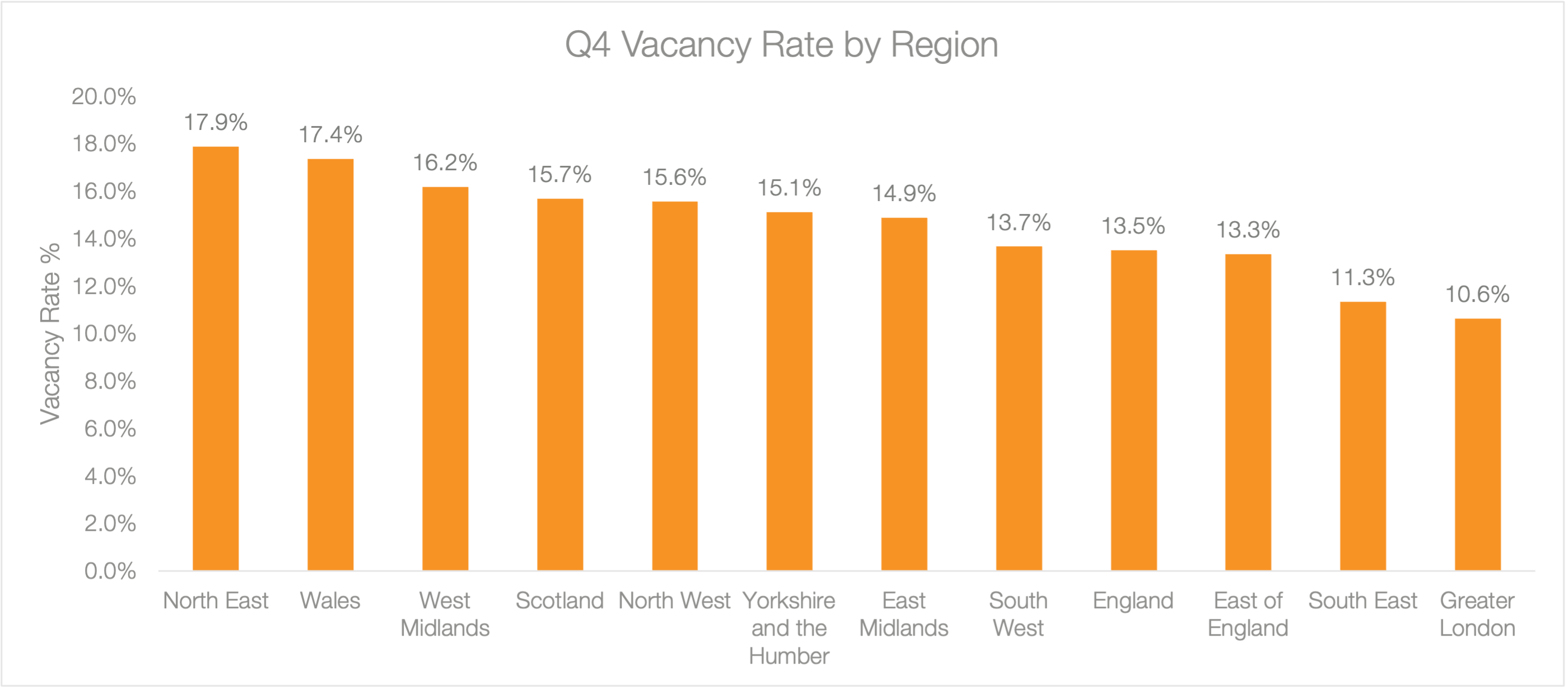

- Geographically, the highest rates were in the North East, though a slight improvement from the same time last year. Greater London has the lowest vacancy rates.

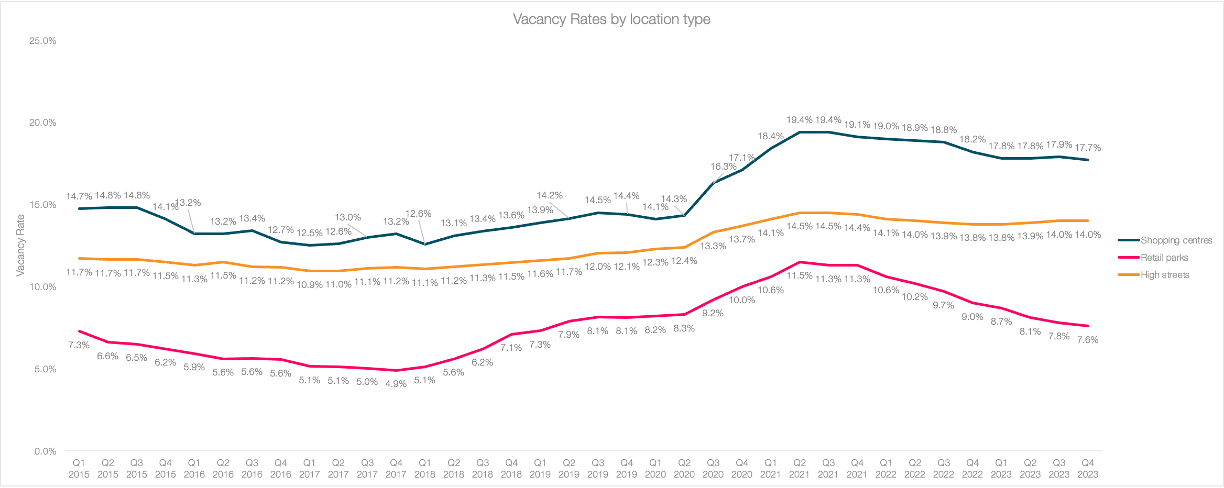

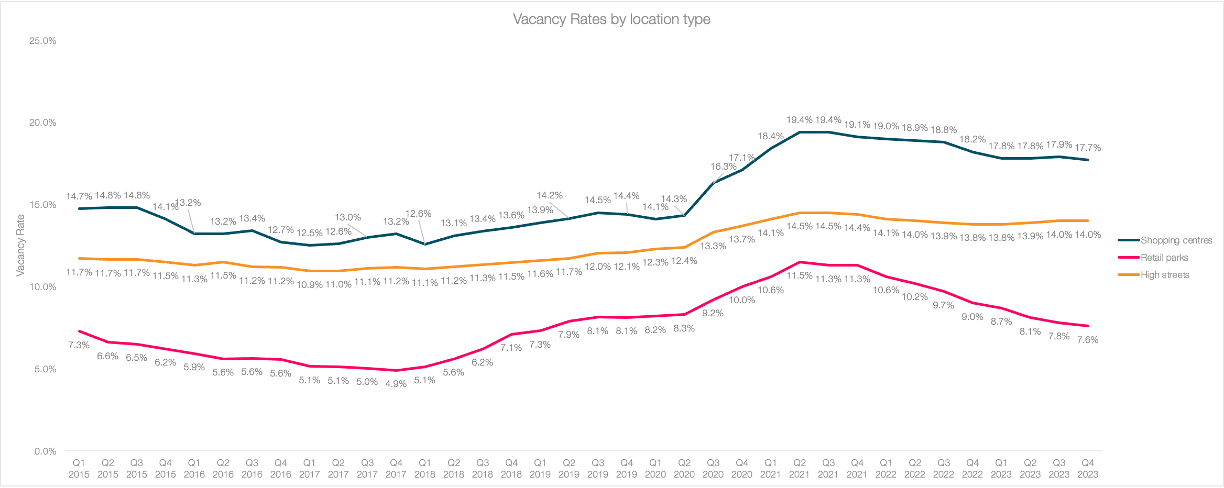

- High Street vacancies, remain unchanged from the previous quarter, staying at 14%.

- Shopping Centre vacancies fell to 17.7%, down from 17.9% in Q3 2023.

- Retail Park vacancies decreased to 7.6% in Q4, which was an improvement on 7.8% in Q3. They continue to be favoured by many GB occupiers, and are set to remain the most popular retail sub-sector.

Lucy Stainton, Commercial Director, Local Data Company, said:

As always, while the latest top-line vacancy data indicates seemingly nominal change, holding steady at 14% quarter on quarter, the reality becomes more nuanced upon closer examination, which is critical to analyse and understand.

This quarter reveals continued notable improvements in both retail parks and shopping centres, with retail parks, in particular, achieving their highest occupancy levels since 2019. We anticipate this positive trend will persist, given the continued focus of a diverse range of operators across various sub-sectors. Grocery-led anchors lead the way, but we also observe an uptick in other categories such as health clubs, health and beauty, and food to go. This diversification enhances the appeal of these parks to consumers, aligning with their broader shopping missions.

Whilst vacancy rates demonstrate continued stability post-pandemic and exhibit promising signs, it is crucial to remain attentive to persistent vacancy levels across GB. These levels serve as robust indicators of areas requiring structural change and substantial stakeholder intervention. Persistent or long-term vacant stock has risen across all location types and asset classes, highlighting the need for targeted redevelopment to address the lack of demand for traditional uses of these spaces.

901

901

901

901