This blog reports on Q1 2022. If you would like to see the most recent results for Q2 2022, download your copy here.

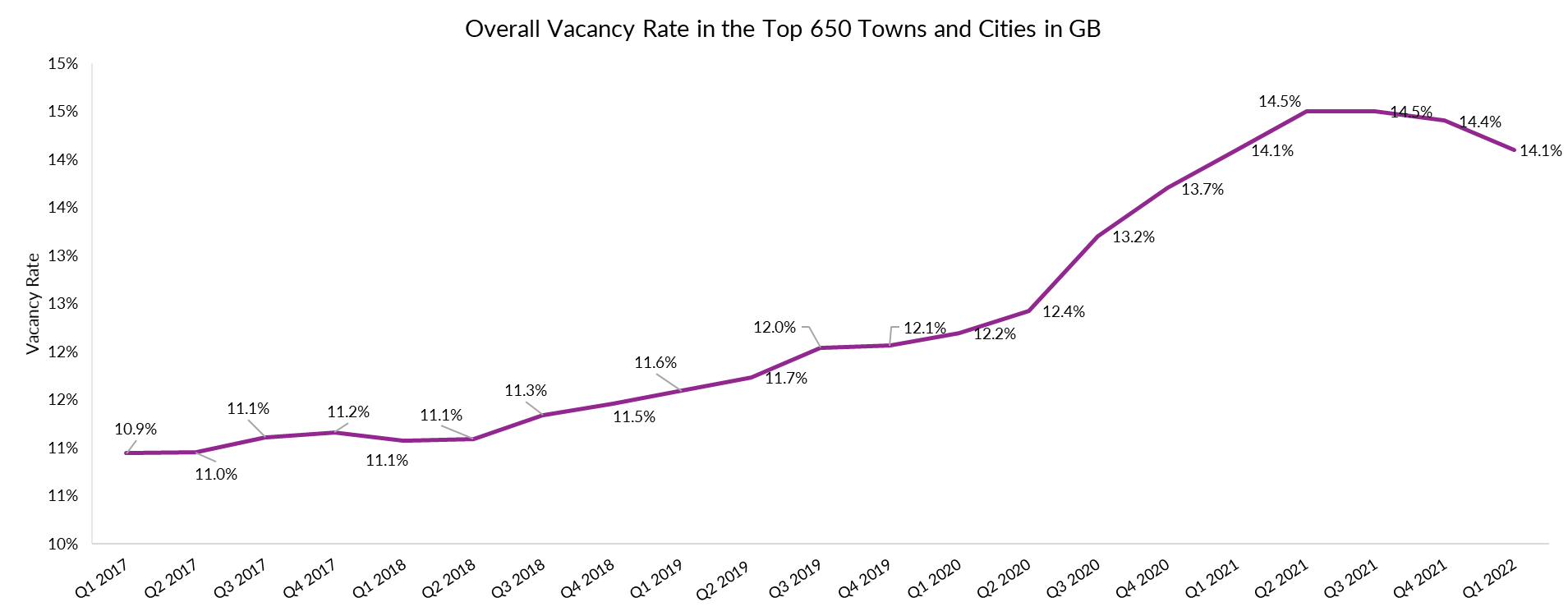

- In the first quarter of 2022, the overall GB vacancy rate decreased to 14.1%, which was a 0.3 percentage point down from Q4 2021. This was only the second quarter of falling vacancy rates since Q1 2018.

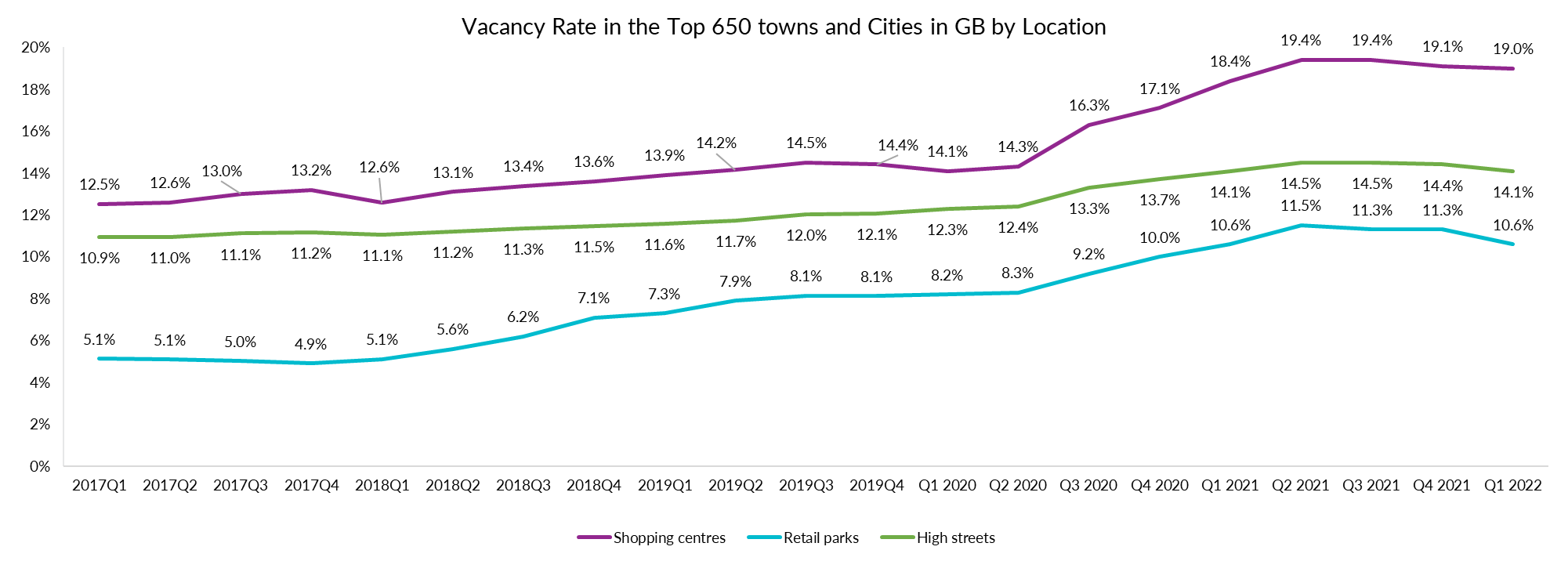

- All locations saw a decrease in vacancies in Q1, with Shopping Centre vacancies falling to 19.0%, down from 19.1% in Q4 2021.

- On the High Street, vacancies decreased to 14.1% in Q1, which was down from 14.4% in Q4 – in line with the overall rate.

- Retail Park vacancies decreased to 10.6% in Q1, a 0.7 percentage point fall from Q4 2021. Also, it remains the location with by far the lowest rate.

Helen Dickinson OBE, Chief Executive of the British Retail Consortium, said:

“The first quarter of this year saw a large quarterly improvement in shop vacancy rates. The economy had fully reopened, with more city workers back in the office, and more tourists out on the streets. This allowed some businesses to grow and invest in repurposing and reopening empty units, especially in retail parks and high streets. Despite this improvement, the overall proportion of empty storefronts remains well above its pre-pandemic levels, especially in the north of England. While many northern regions saw the biggest quarterly improvement, they still have the highest vacancy rates in the country as they were hit harder by the pandemic and have a lower average level of disposable income.

“Much has changed with the cost of living rising and the conflict in Ukraine damaging consumer confidence. It remains to be seen how the increasing costs and the war in Ukraine will impact on businesses and the vacancy rate in the future. While people’s shopping habits have changed, the need for vibrant communities at the centre of our towns and cities has not. Government should look to reform business rates so that businesses can invest in these areas that need it the most.”

Lucy Stainton, Director, Local Data Company, said:

“The latest figures show a continued— and welcome— reduction in empty units across nearly all regions in England as well as across both Scotland and Wales, as market recovery continues post-Covid. This decline in vacant space is being driven by further repurposing of retail space, growth in the independents sector and an increase in activity across the chains as well, as many brands are back on the acquisition trail after the pandemic stalled growth.

“Anecdotally, we are aware of rising competition for prime space in both city centres and shopping centres, from both chain retail and leisure operators. This may lead to further polarisation in key locations as activity is concentrated in prime pitches, leaving more tertiary space behind. That being said, this continued decline in vacancy rates is further evidence of more sustained recovery. Whilst there are a number of well-publicised economic headwinds on the horizon, we might still remain optimistic that a proactive, concerted focus on the future of consumer-facing real estate will yield further recovery.”

| |

|

Current |

1 Quarter Ago |

1 Year Ago |

|

Rank

|

|

Q1 2022

|

Q4 2021

|

Q1 2021

|

|

1

|

Greater London

|

11.1%

|

11.0%

|

10.7%

|

|

2

|

South East

|

11.8%

|

12.2%

|

12.7%

|

|

3

|

East of England

|

12.9%

|

13.1%

|

14.1%

|

|

4

|

South West

|

13.6%

|

14.0%

|

14.4%

|

|

5

|

East Midlands

|

15.1%

|

15.5%

|

16.3%

|

|

6

|

Yorkshire and the Humber

|

15.4%

|

15.8%

|

17.0%

|

|

7

|

North West

|

15.7%

|

16.2%

|

17.7%

|

|

8

|

West Midlands

|

15.8%

|

15.7%

|

16.9%

|

|

9

|

Scotland

|

15.8%

|

16.1%

|

15.3%

|

|

10

|

Wales

|

16.9%

|

17.5%

|

19.2%

|

|

11

|

North East

|

18.8%

|

19.9%

|

18.8%

|

-ENDS-

For media enquiries:

BRC Press Office

Lara Conradie

T: 020 7854 8924

M: 07785 612 214

E: lara.conradie@brc.org.uk / media@brc.org.uk

LDC Press Office

E: press@localdatacompany.com

901

901

901

901