One year on from our blog detailing the historic trends on Oxford Street, LDC has revisited the latest data to investigate what has changed since 2023 and discuss what we can expect to see from this key shopping street in the future.

Oxford Street endured a turbulent year and was rarely away from the headlines, for all the wrong reasons. Westminster Council’s attempts to stamp out American Candy stores, Marks & Spencer’s well publicised planning dispute with Michael Gove, the continued debate on the abolishment of VAT free shopping for visitors to the UK and even a viral Tik-Tok which caused JD Sports to be targeted for theft in August all caused headaches for retailers and landlords alike during 2023.

However, data from early 2024 indicates a turnaround for Oxford Street, hinting at a recovery for the area. Increasing numbers of workers are returning to the office for larger portions of the week, the new Elizabeth Line station opened and a proposed £90m investment to widen pavements and make other improvements will all have been music to the ears of the landlords in the area. Additionally, Oxford Street was positively impacted by the reduction in business rates which meant rates were cut by up to 40% on some properties on the street, improving affordability for retailers.

American Candy Shops

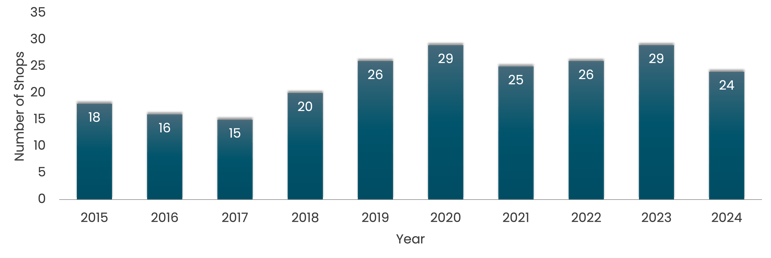

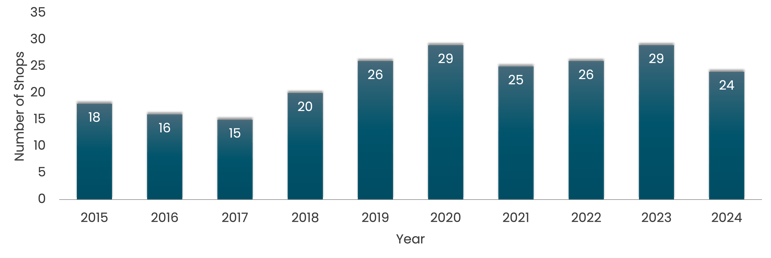

Oxford Street Candy & Souvenir Shops 2015-2024

The main concern regarding Oxford Street in recent years was the proliferation of the so-called “American Candy Shops” which blighted the street and took over large numbers of units offering low quality or even illegal products.

The number of these stores peaked in 2019 and 2023 at 29 and various attempts have been made by Westminster Council to clamp down on the illicit trading associated with these businesses. These actions appear to have paid off, with the number of stores dropping to 24, the lowest number seen on the street since 2018. It is expected that this number will continue to fall as reputable retailers begin to take up space once again.

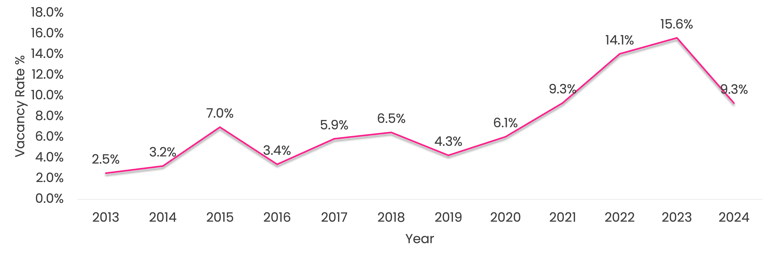

Vacancy Rate

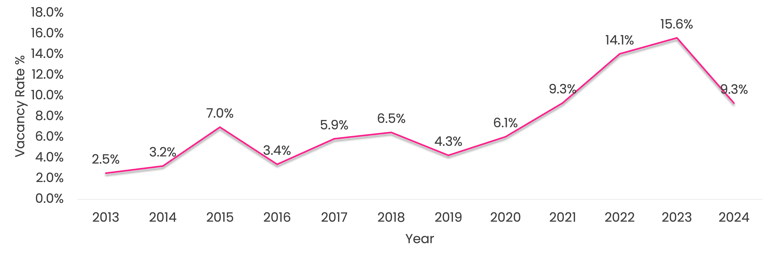

Oxford Street Vacancy Rate % 2013-2024

Oxford Street saw vacancy rates soar post-covid, increasing every year through to 2023, where the of the cost-of-living crisis caused consumers to reduce spending on non-essential items. The abolishment of VAT free shopping for tourists dealt a further blow to the area in 2019, with many visitors taking their spend elsewhere in Europe where these discounts were still on offer.

However, in a positive turn of events vacancy rates on the street have made a remarkable recovery, dropping back to 9.3% by February 2024, the lowest levels seen since 2021. Several new openings by household brand names and new international entrants throughout 2023 meant the cloud over Oxford Street is showing signs of clearing.

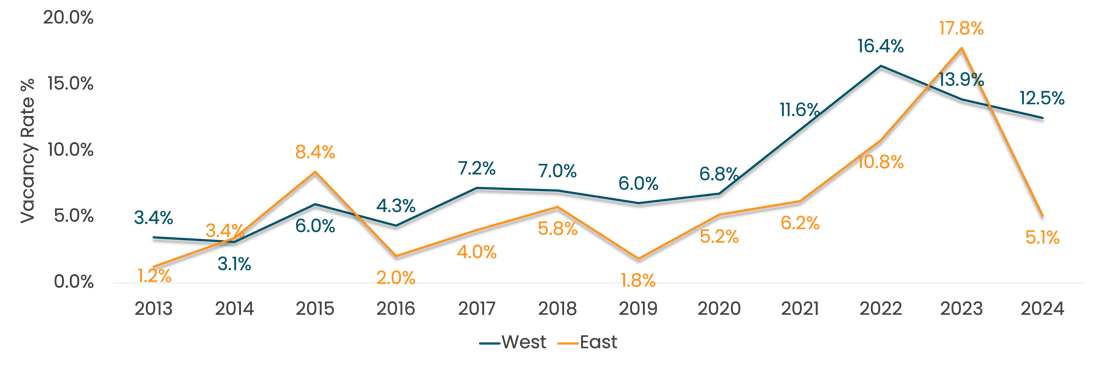

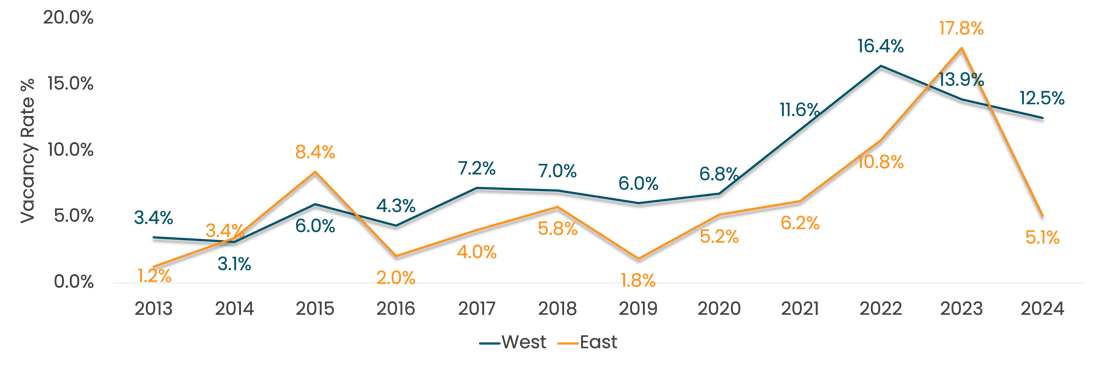

Oxford Street Vacancy Rate % - East vs West

LDC looked in more detail at the physical make up of Oxford Street and how vacancy rates differ across the street. The above chart shows vacancy rates at the East and West ends of the street if Oxford Street were to be theoretically split in half at the Regent Street crossroads.

East Oxford Street, running from Tottenham Court Road to Oxford Circus, historically has seen lower vacancy rates to the West of the street. However post-covid, this area saw a dramatic increase in vacancy rates which went above the West of the street for the first time since 2015. By early 2024 vacancy rates had significantly improved to only 5.1% of units, following a swathe of new openings at the back end of 2023. Pandora, The Fragrance Shop, Miniso, Dr. Martens and House of CB all opened new stores during this time. The opening of the new Elizabeth Line station at Tottenham Court Road likely provided a welcome boost to this area and there has been huge investment made in redevelopments in this section of the street.

West Oxford Street, which runs from Oxford Circus to Marble Arch, has been slower to recover from vacancy spikes seen in a post-covid world. The closures of both Debenhams and House of Fraser were strongly felt in this area. Current vacancy rates stand at 12.5% and new openings were more muted on this section of the street. However, there were still notable openings from Under Armour and Kurt Geiger in H2 2023, injecting a boost of investment to the area.

Vacancy rates are predicted to continue falling across the whole of Oxford Street as several new openings are planned in the upcoming months. The eagerly anticipated Ikea is due to open in the ex-Topshop building in Autumn which will provide a huge amount of interest and footfall to the area. Uniqlo, NBA and Krispie Kreme are all in fit out stages for new stores with other brands such as Victoria’s Secret in talks to take on further units.

Oxford Street could also see an influx of independent brands as New West End Company launched a partnership with Westminster Council offering up to 35 small and creative businesses a chance to have a store on Oxford Street rent free for six months. These businesses will inject a new buzz and vibrancy to the area and should attract vast amounts of new visitors.

Redevelopment

There is also an increasing shift towards redevelopment on Oxford Street with many vacant units turning to new uses such as office space or leisure. John Lewis is pushing ahead with plans to sell off a huge portion of its store for conversion into office space, thus reducing the retail space of the store and creating a new use for the largely empty upper floors of the building.

Leisure uses have increased with the basement floors of both Debenhams and House of Fraser being converted into entertainment venues. Art venues such as Twist Museum, which opened in 2022, are bringing a new lease of life to vacant units on the street previously only taken up by retailers. Pocket Planet an “immersive miniverse” concept is planned to take up to 30,000sqft of space on Oxford Street in 2025 and MOCA Museum is in talks to take over a building on the west of the street. These new attractions will bring a significant boost in visitors to the street each year and reflect a shift towards more diversified uses away from a purely retailer offering, promising increased footfall and vitality.

Despite recent challenges, Oxford Street is in a state of flux and appears poised for resurgence. We can expect to see continued new and exciting openings on the street for several years to come as the large-scale redevelopment works which are currently in progress come to an end and find occupiers. Oxford Street may have taken some hard knocks in past few years, but all signs show it to be coming back strong and fighting for its place as one of the premier shopping destinations in GB.

901

901

901

901