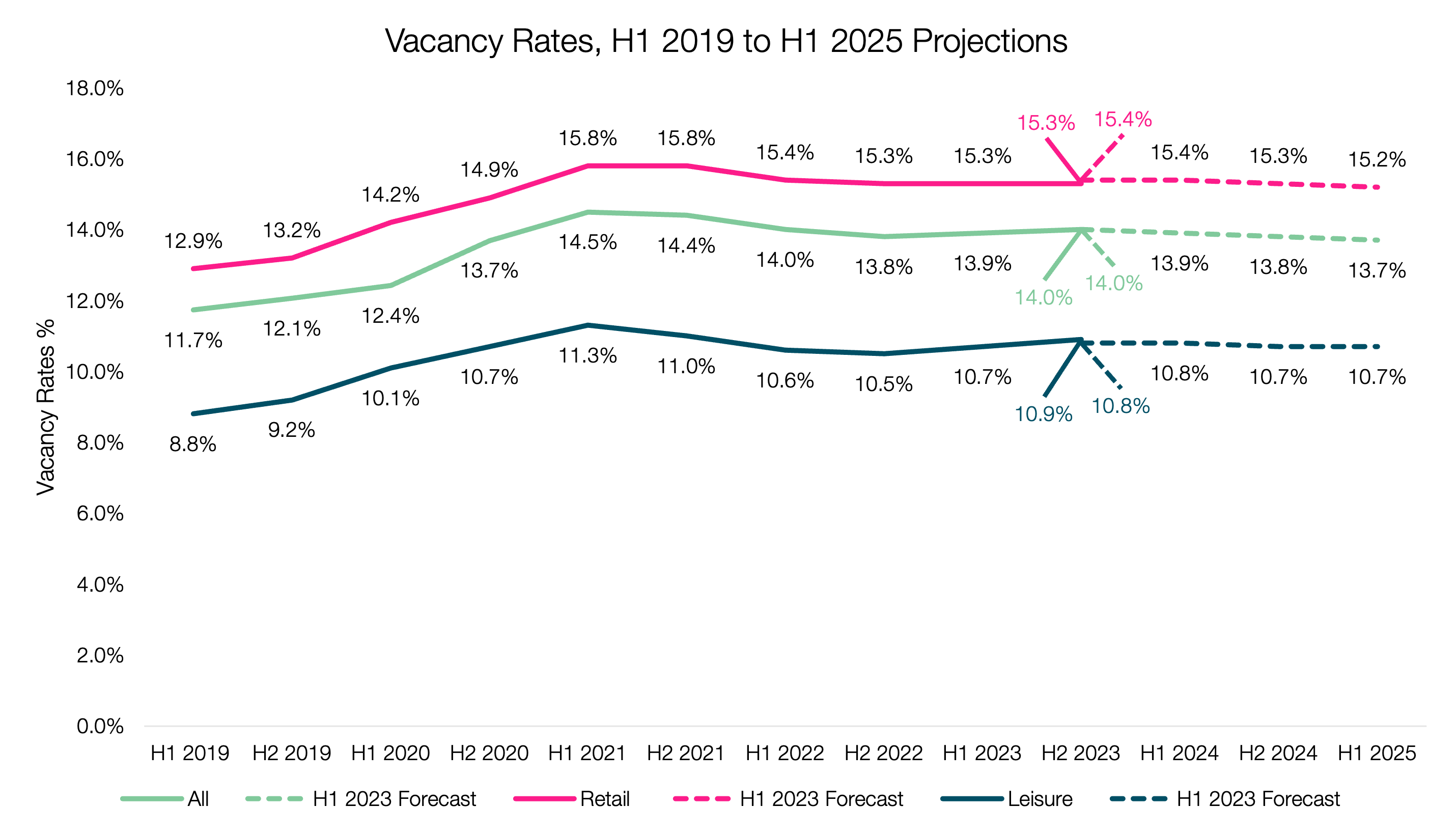

Vacancy Rates

We anticipated the All Vacancy Rate to remain level at 14.0% to end 2023. This projection remained true, with the retail and leisure landscape having maintained a balance between economic headwinds and the recovery in consumer confidence for rates to remain level since H1 2023.

Performing 0.1% better than predicted, Retail Vacancy Rate ended 2023 on 15.3%. Despite levels remaining high, the retail sector has remained consistent for the past year. Along with a relative lack of major retail casualties, Retail Vacancy Rates have been helped by retailers recognising the value of the physical store. There has been a significant shift to physical retail from many brands and we have seen several brands (including former online-only) secure their first UK retail space, including Sephora in March 2023. Whilst having a strong online offering is now vital for most retailers, having a quality omnichannel approach where both online and physical work in tandem is proving important post pandemic.

The leisure sector continues to face extreme pressures, with factors such as the cost-of- living crisis, rising energy prices and staff retention contributing to rising Leisure Vacancy Rates. Considering this, we anticipated rates to rise to 10.8%, however the end of 2023 saw Leisure Vacancy Rates increase to 10.9%. Pubs had the most closures in 2023, with the challenges they face being hard to manage, particularly for small and independent pub owners facing rising rents, high operating costs, or increased competition.

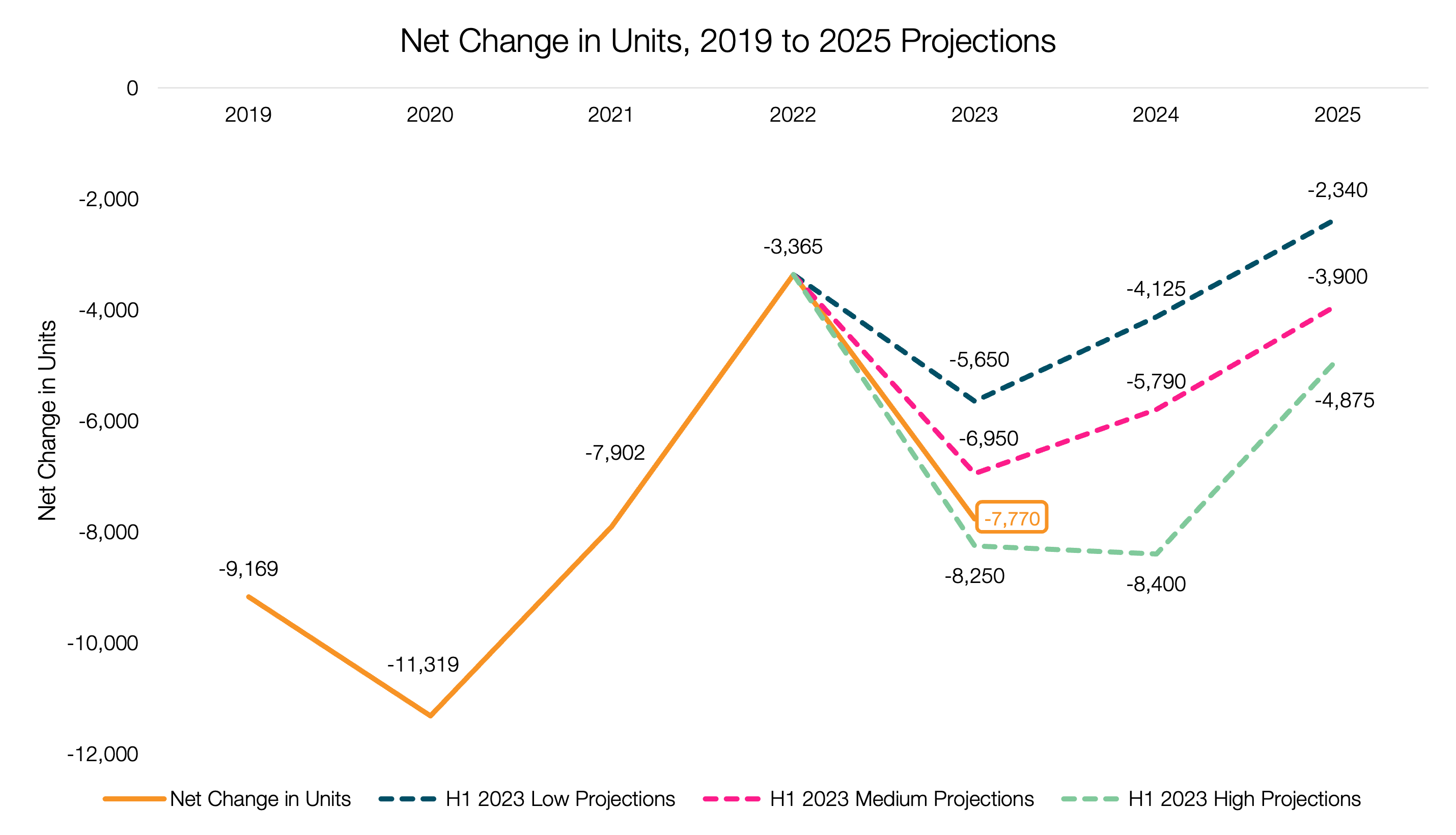

Openings & Closures

Our openings and closures forecasts take a range of factors into account, considering current market trends and the expected trajectory for economic recovery. For 2023, the net change in units illustrates more closures compared to openings, sitting at -7,770. This result lies closer to the forecasted high projections figure of -8,250, indicating a poorer performance than both medium and low projections for 2023.

Predicted figures captured the economic headwinds such as soaring inflation putting pressure on growth within the retail and leisure sectors. However, it also considered factors helping the market recover such as redevelopment plans beginning and the advances in growth in technology. Despite methods of forecasting figures, the second half of 2023 encountered events unforeseen, such as geopolitical competition increasing and ongoing wars ground on. In addition, economic decisions to increase interest rates in August 2023 (the highest for nearly 16 years) – having a major bearing on the UK consumer and their ability to eat, shop and play.

With the ever-changing landscape of the retail and leisure industry means that occupiers face increasing levels of complexity in the year ahead. To read more about key developments across the entire GB retail and leisure market over the past year, download the Local Data Company's new FY 2023 report with insights from parent company Green Street.

901

901

901

901