Despite shopping centres having the highest vacancy rates out of any location type, the number of shopping centres fully occupied across GB has been increasing since 2022. Whilst percentages are relatively low, the number of shopping centres at full capacity over the past 5 years was at its highest in 2019 (6.8%), with Covid-19 inevitably contributing to reducing rates in the years that followed. Figures from 2023 indicate 5.7% of the total number of shopping centres in GB are fully occupied, with this trajectory having the potential to continue after the success of redeveloped centres and retailers recognising the value of the physical store.

In line with improving GB shopping centre vacancy rates since Q4 2021, shopping centres across the country have experienced a high volume of openings as the market sentiment picked up in the recovery years post Covid-19, in turn contributing to more and more shopping centres becoming fully occupied. In terms of location, in 2023, the regions with the most improvement and hold the highest shopping centre full occupancy scores include the West Midlands (8.8%), North-East (7.5%) and Yorkshire and the Humber (7.4%).

Methods helping shopping centres recover includes new ownership, looking to maximise value and boost recovery through asset management and proactive leasing, in addition to redevelopment efforts focused on repositioning centres to meet the needs of the local catchment. Many landlords have sought food halls, cafés, restaurant concepts and entertainment venues to reoccupy former retail units, a trend consistent across both small-format (former fashion shops) and large-format (former department stores) stores.

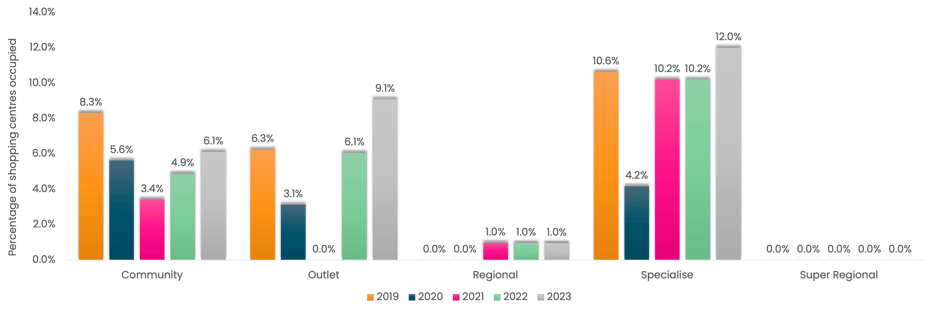

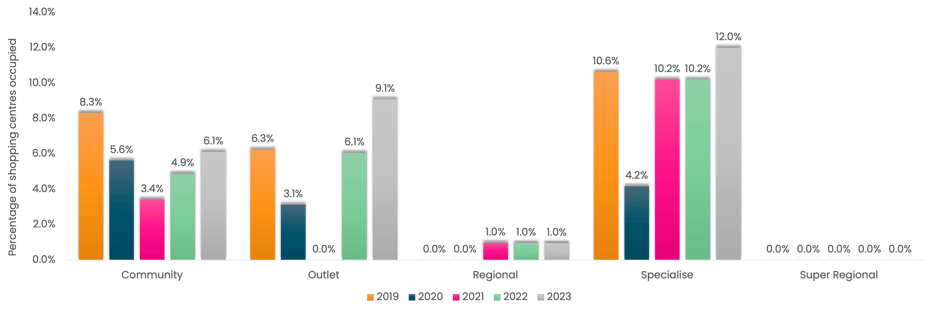

Segmentation Type

Percentage of Shopping Centres in GB Fully Occupied by Segmentation Type

(Source: Local Data Company)

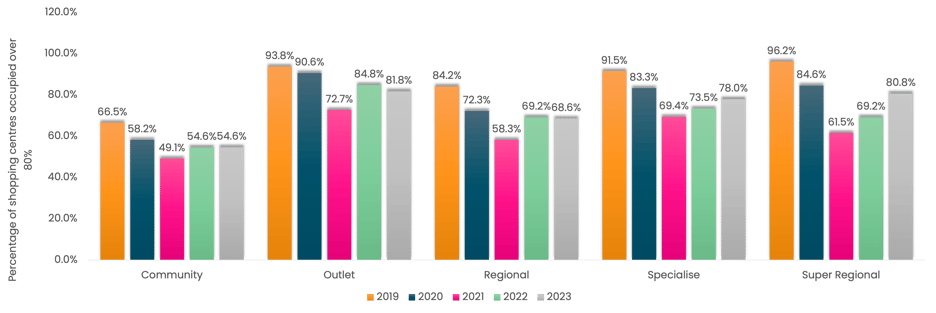

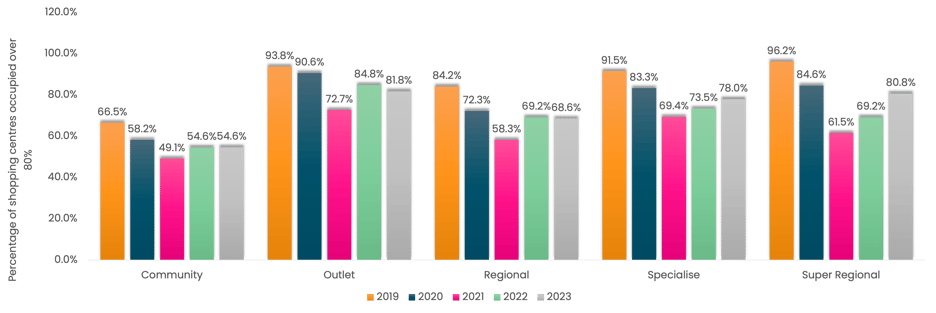

Percentage of Shopping Centres in GB Occupied over 80% by Segmentation Type

(Source: Local Data Company)

Looking at shopping centres by segmentation demonstrates what type of shopping centres have the greatest number at full capacity. Specialise centres refer to those with local catchment focus, and can be prominent in Greater London and densely populated areas. This segmentation type has a greater number of full occupancy compared to other segments, with all years (minus 2020) having an average of 10.8% of total centres with a 0% vacancy rate. Factors such as agile working has seen a strengthening for retail in these types of locations, particularly for centres with a food and beverage offering.

Despite super regional centres having none at full capacity, these hold some of the highest percentages for the number of centres over 80% capacity, with the number increasing since 2021, now with 80.8% of super regional shopping centres having a 19% vacancy rate or less. An advantage for these bigger centres includes brands continuing to reposition and upscale their offer within key retail markets, and often in prime city centres. Along with this, the rise in omnichannel shopping has helped brands secure space in centres creating opportunities for them to diversify and expand their ranges in line with their online offer.

Regional and super regional centres will always have the challenge of being 100% occupied due to the high number of units they hold, making it difficult for them to all be filled, compared to other segmentation types.

Taking unit size and purpose into consideration, community and outlets have an advantage over other segments. Examples include requiring a smaller number of units and in turn being easier to refill. In addition to this, these centres have more of a specific shopping purpose, either serving the needs of the community/local catchment, or with outlets, having a targeted retail offering demanding space from limited locations. It is worth noting, community shopping centres have the lowest occupancy rates, with only half of its centres in GB being over 80% filled (in 2023) and a handful being fully occupied, over the past 5 years.

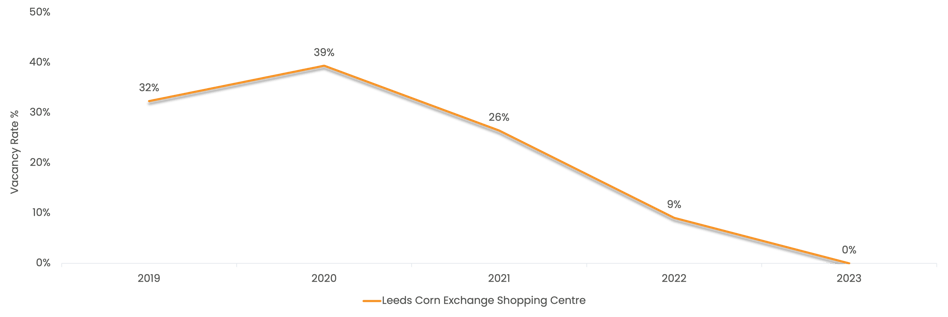

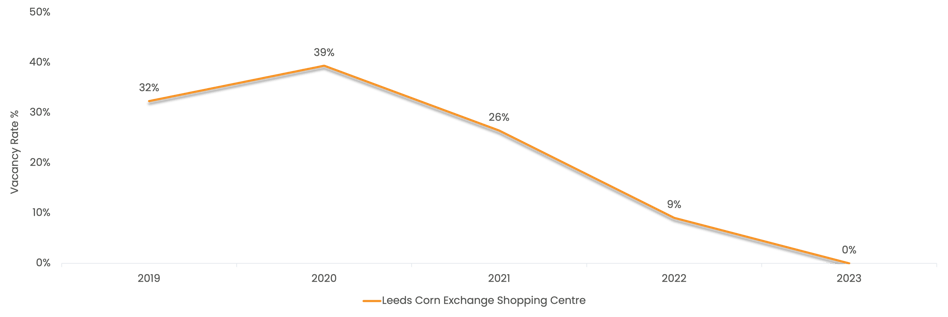

Case Study

Leeds Corn Exchange Vacancy Rates (2019-2023)

(Source: Local Data Company)

Leeds Corn Exchange is an example of a shopping centre to have experienced notable improvements in vacancy rate scores, encouraged by major regeneration investment to the surrounding area.

The area around Leeds Corn Exchange has been transformed by a public realm scheme and a major package of Connecting Leeds highways improvements, with the latter forming part of the £173.5m Leeds Public Transport Investment Programme (Source: Leeds City Council). Pedestrianised open space in front of the Grade I listed Corn Exchange shopping centre, as well as new bus and cycle infrastructure being put in place, has helped revive the area and improve accessibility. Factors like these play a role in making the area more investable and help unlock its full commercial potential.

The shopping centre, now at 0% vacancy rate, is fully occupied by independents. Independent retailers can be more agile in responding to changing market trends and customer needs. They are not bound by the rigid structures and decision-making processes of large businesses, allowing them to quickly adapt and experiment with new ideas – and in this case maintain high occupancy levels. Furthermore, supporting independent retailers contributes to the local economy, with these businesses often sourcing their products locally, employ local residents, and recycle a significant portion of their revenue back into the community.

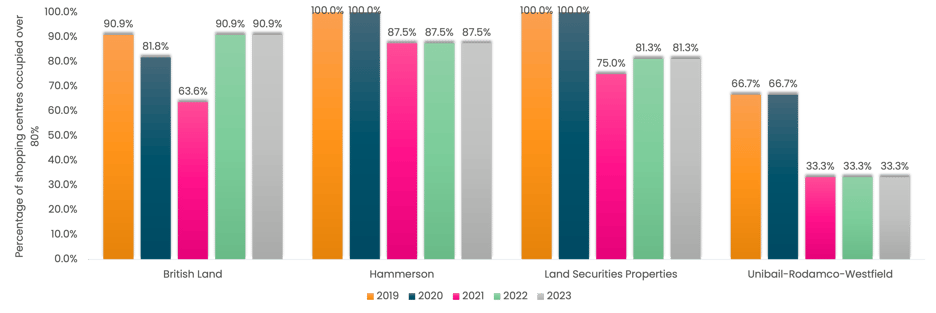

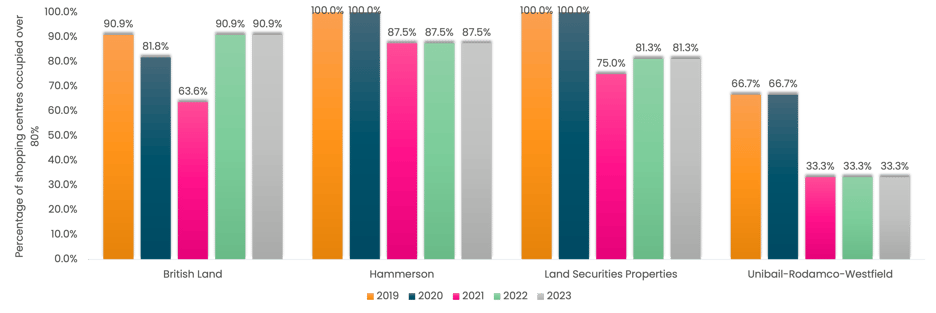

Asset Owners

Percentage of Shopping Centres Occupied over 80% by REIT's

(Source: Local Data Company)

Analysing shopping centre occupancy levels by asset owner illustrates a relatively strong recovery effort in the years following Covid-19. Figures are lower for Unibail-Rodamco-Westfield due to the ownership of 3 centres compared to the other REIT’s owning 8+.

Land Sec and British Land have a greater ownership in the number of centres out of the 4, with both demonstrating improvements to occupancy levels since 2021. In 2023, British Land achieved pre Covid-19 figures, with 90.9% of its centres being over 80% occupied. Compared to Land Sec, who are yet to return to having their whole estate at 100% to holding an over 80% occupancy rate.

Larger shopping centres have been supported by a great deal of interest from major retailers, who have been consolidating their estates to focus on larger stores in prominent locations or for existing tenants looking to upsize. Shopping centres have also benefit from flexible, turnover-based rents and the resilience of luxury and outlet retail amid current economic pressures - with Land Sec in particular benefitting from the success in outlets.

Methodology*

Shopping centres used in this analysis include those with 10 or more units only.

901

901

901

901