The British Retail Consortium is proud to announce its new partnership with the Local Data Company to create the BRC-LDC Vacancy Monitor. The launch coincides with one of the biggest upheavals to the global economy in modern history, this quarterly vacancy monitor will track changes to the GB retail landscape as they evolve over the coming quarters. This report measures vacancy data in Q1, prior to the Lockdown, so does not reflect the changes as a result of the coronavirus pandemic.

This blog reports on Q1 2020. If you would like to see the most recent results for Q2 2022, download your copy here.

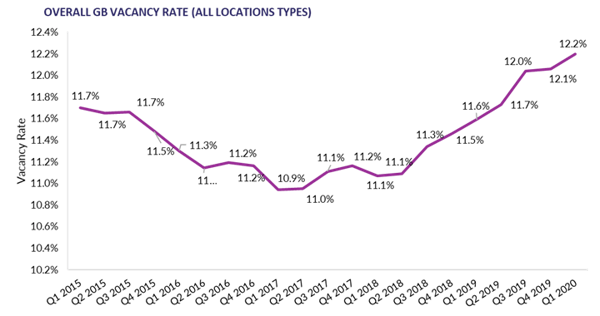

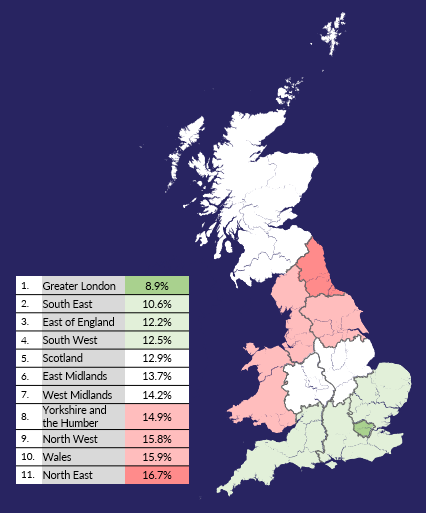

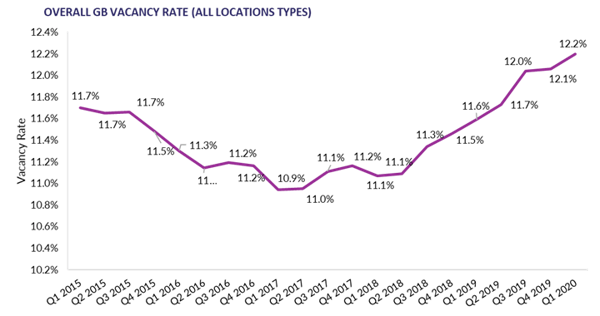

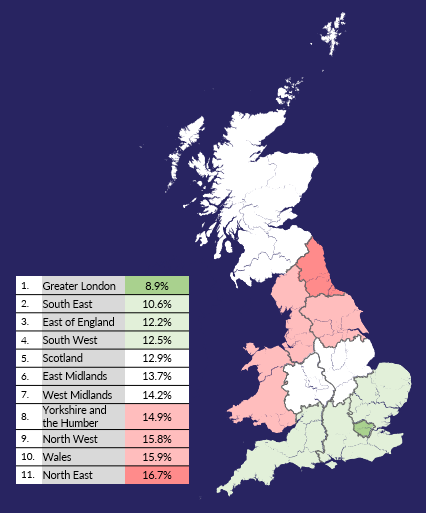

- The GB vacancy rate across all shopping locations was 12.2% in March 2020, an increase from 12.1% in December 2020.

- The vacancy rate was 12.3% for High Streets (12.1% in Dec19); 14.1% for Shopping Centres (14.4% in Dec19); and 8.2% for Retail Parks (8.1% in Dec19).

- Persistent vacancy rate - premises empty for two or more years – was 5.3%.

- The South West and Wales saw the largest increases in the vacancy rate, at 0.6 and 0.4 percentage points respectively. The North West saw the largest decline of 0.2 percentage points.

Helen Dickinson OBE, Chief Executive of the British Retail Consortium, said:

“For some time retail parks have been faring better than High Streets and Shopping Centres as consumers took advantage of free parking and larger stores. The coronavirus pandemic is likely to exacerbate this disparity as most retail parks include large supermarkets which have remained open to meet the public’s needs. Despite Government support, it is likely that some stores may not be able to reopen after the lockdown is lifted, and the vacancy rate may rise sharply in the future as a result.

“With over three million retail jobs in the UK it is vital that as many firms as possible can start trading again once lockdown is lifted. While the Government furlough scheme, loans and business rates holiday have provided an essential lifeline for thousands of retailers, stores continue to face fixed costs such as rent, which threaten their existence. To protect jobs and ensure the economy is able to get back on its feet in the coming months, it is vital that the follows the lead of other European countries and supports rents."

Lucy Stainton, Head of Retail and Strategic Partnerships at LDC, said:

“The inaugural BRC-LDC Vacancy Monitor shows a consistent increase in the number of stores lying empty overall, which indicates that the UK now has more retail space than is necessary to meet our changing consumer habits. Given the pandemic, as well as the CVAs and administrations that have already taken place, plus the huge challenge to cash flow for all of the non-essential businesses forced to close, we are predicting that the vacancy rate will increase on a much steeper trajectory than originally anticipated this year.

“However, LDC data over the past few years has revealed that the independent retail space has proven more resilient than chain retailing. Might we expect to see the agility of these businesses, as well as a move to more localised shopping, continue to boost this sector, or will the onset of the financial challenges presented by COVID-19 overwhelm our independent retailers? With independents currently representing 64% of the total UK retail landscape, the impact on this corner of the sector will be hugely influential to the overall health of our high streets.”

For more information on 2019 trends, download the latest Local Data Company analysis via the button below.

901

901

901

901