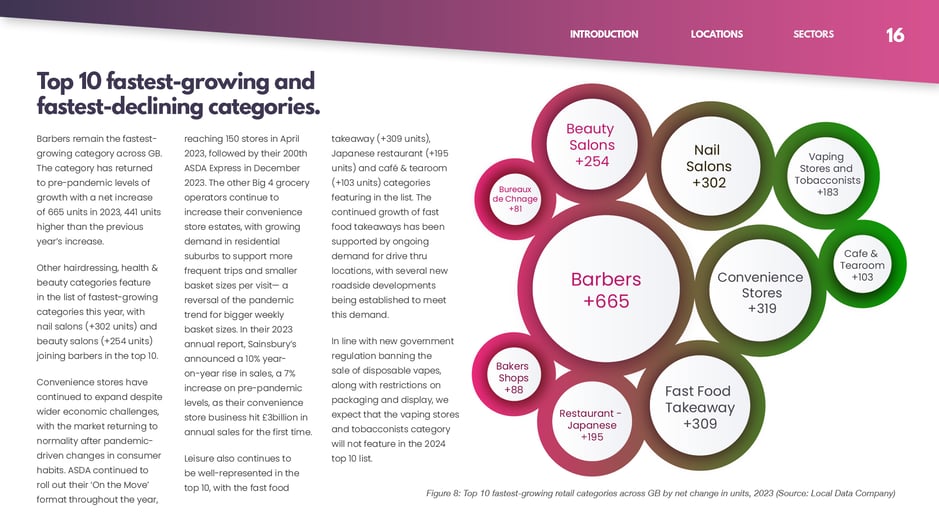

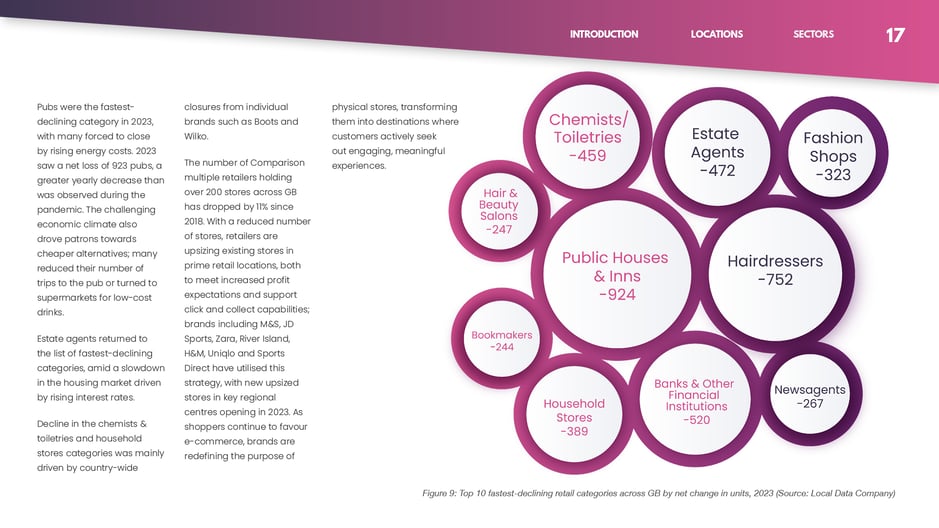

Growth and Decline: Exploring the Surge of Barbers and the Decline of Pubs

Date published: 2024-04-03 Date modified: 2024-04-10

Author

Hayley Kennedy

The Local Data Company

901

901

901

901

After completing her degree in Retail, Marketing & Management, Hayley went on to build a successful career between 2009 and 2019 as a merchandiser working for established retailers such as Arcadia and The White Company. Her last two roles at The White Company and Soho House (Cowshed) were maternity cover contracts and, because of her career moves, she is highly adaptable. A vast proportion of Hayley's role as Merchandiser was dedicated to numbers: data collection and data analysis working with raw data focused on stores, individual products, product lines, stock management, sales and returns.