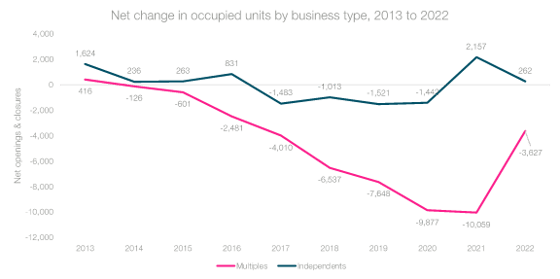

Figure 2: Historical net change in occupied units by business type across GB, 2013 to 2022 (Source: Local Data Company)

- Following a large net increase of 2,157 units across 2021, the independent store sector did not perform as well over 2022, with a net increase of only 262. Independents have been particularly impacted by the energy crisis and the removal of some government support schemes. Having been affected by a raft of CVAs and administrations in the previous few years, multiples fared much better in 2022, with net decline in units rising from -10,059 in 2021 to -3,627. This represents the best performance for the multiples sector since 2016.

Comment from Lucy Stainton, Commercial Director, Local Data Company:

“As 2022 came to a close we were able to reflect on our first full year on the other side of a global pandemic. Happily as the year progressed, we were charting some of the most positive statistics we have seen since 2016, namely the largest decrease in vacancy rates in a given period and the fewest net closures. That’s not to say 2022 hasn’t been marred by some phenomenally tough economic headwinds which squeezed both businesses and consumers with unhelpful circularity.

In particular, whilst overall market performance did improve, independent businesses have started to feel the pinch from the impact of the cost of living crisis and this is reflected in the slowdown in openings and increase in closures. Soaring energy costs, combined with lower levels of disposable income for consumers, have led to some independent businesses falling into trouble and closing their doors for good. Government packages designed to support small businesses recovery post-covid also came to an end, causing additional pressure.

However, it’s important to acknowledge that openings are still strong – both across the independents and chains. This shows that despite a tough economic backdrop, local entrepreneurs are still active, and the larger chain retail and leisure operators have the infrastructure and agility to navigate these tests.

I think it’s also interesting to note the slowdown in online activity, with pressures experienced by pure play brands and a returned affection for bricks and mortar shopping, again, reflected in the latest statistics. Q1 2023 has already seen new international entrants to the UK market, brands committing to open more stores and a focus on placemaking, regeneration and redevelopment. Whilst we know it’s going to continue to be tough for a while – when is it ever easy? – 2023 will hopefully prove another year of recovery and stabilisation."

ENDS

Notes for editors

Please contact the LDC Press Office with any additional data or interview requests at press@localdatacompany.com or 07889591487.

The full report is available to download now. Please click here to download a copy or email the Press Office.

The full report will include further detail on:

- Openings and closures

- Vacancy rates across GB by location type (high streets, retail parks and shopping centres) and region

- Redevelopment activity

- The early impacts of the cost-of-living crisis on retail subcategories

- The fastest-growing and declining subcategories

- The outlook for 2023 and beyond, amid continuing economic pressures

Methodology

The Local Data Company visits over 5,250 towns and cities (retail centres and government-defined retail core), retail parks and shopping centres across England, Scotland and Wales. Each premises is visited, and its occupancy status recorded as occupied, vacant or demolished.

Each centre has been physically walked and each site recorded as vacant, occupied, or demolished on the day of survey. Vacant units are units which did not have a trading business on the premises on the day of survey.

Locations are updated on a 6- to 12-month cycle depending on size and churn, with both a field survey team and an office research team tracking local market changes.

‘Retail’ refers to convenience, comparison goods and service retail. ‘Leisure’ refers to entertainment venues, restaurants, bars, pubs, clubs, coffee shops and fast food outlets. ‘Independent retailers’ are businesses with fewer than five stores nationwide, and no international presence.

The GB vacancy rate analyses the top 650 town centres across England, Wales and Scotland.

About the Local Data Company

The Local Data Company is the UK’s most accurate provider of retail and leisure location data. We are the only company to physically monitor every brick-and-mortar retail and leisure business across Britain’s high streets, retail parks and shopping centres. Our dedicated team of field researchers physically survey over 700,000 units each year. Daily updates are sent to our office research team, who verify all data through our rigorous quality control processes before it is uploaded to our database. This unique methodology allows us to offer the most accurate, real-time view of the market possible.

Our proprietary database underpins our market-leading range of products and services, from our online insights platform to raw data exports and strategic consultancy projects. 2023 marks LDC’s 20th anniversary, and our 10th year of in-depth data collection on the entire addressable market in GB.

For more information, please see www.localdatacompany.com.

901

901

901

901