LDC Press Office

Sarah Phillips

T: 07889 591 487

E: sarah@localdatacompany.com

BRC Press Office

Lara Conradie

T: 020 7854 8924

M: 07785 612 214

E: lara.conradie@brc.org.uk / media@brc.org.uk

Fewer vacant stores by end of 2022

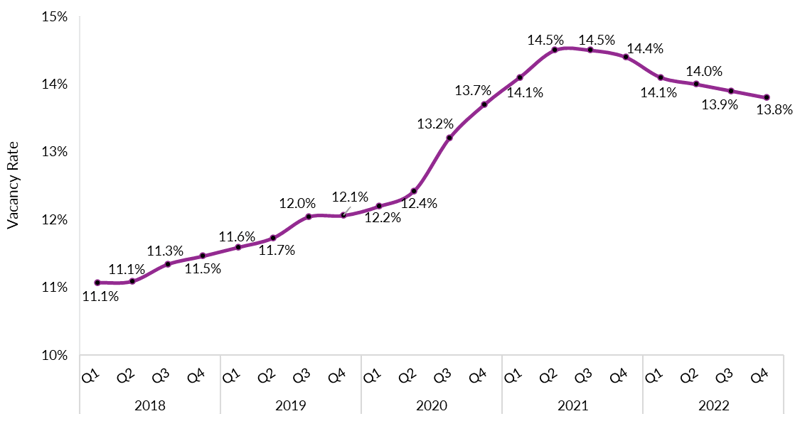

• In the fourth quarter of 2022, the overall GB vacancy rate improved to 13.8%, which was 0.1 percentage points better than Q3 and 0.6 percentage points better than the same period last year. This was the fifth consecutive quarter of falling vacancy rates.

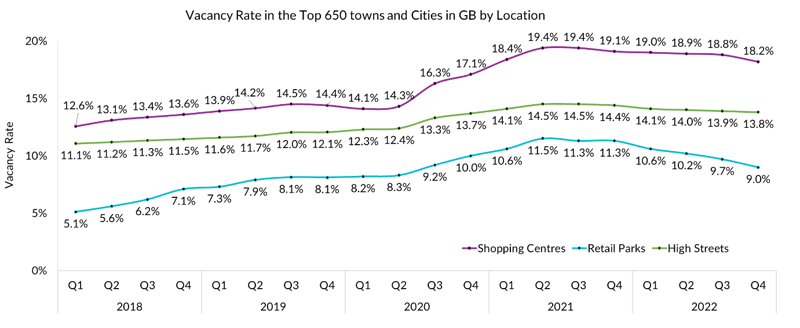

• All locations saw improvements in vacancy rates in Q4:

o Shopping Centre vacancies improved to 18.2%, down from 18.8% in Q3 2022.

o High Street vacancies improved to 13.8% in Q4, compared to 13.9% in Q3.

o Retail Park vacancies improved to 9.0% in Q4, a 0.7 percentage point reduction from Q3 2022. Also, it continues to remain the retail location with by far the lowest vacancy rate.

• Geographically, Greater London, South East and East of England had the lowest vacancy rates. The highest rates were in the North East, followed by Wales and the West Midlands.

Comment from Helen Dickinson OBE, Chief Executive, British Retail Consortium:

“While the number of empty stores reduced in the final quarter of 2022, vacancy rates have not recovered to pre-pandemic levels. Retail occupancy was boosted by the return of international tourists visiting UK towns and cities and more frequent visits to offices. These trends have given many retailers the confidence to invest in repurposing and reopening empty units. The North East, in particular, has benefitted from this investment boost, with the region seeing the biggest increase in store openings. However, it still lags behind other parts of the UK, with the highest vacancy rate in the country.

“The first half of 2023 will likely be yet another challenging time for retailers and their customers. There are few signs that retailers’ input costs will ease, putting further pressure on margins, and making businesses think twice on how much investment to make. However, the situation should improve in the second half of the year, as inflationary pressures begin to ease and consumer confidence is expected to return.”

Comment from Lucy Stainton, Commercial Director, Local Data Company:

“With vacancy rates being such a good barometer of the overall health of the physical retail and leisure landscape, it’s really positive to see the number of empty units at a GB level continuing to fall since they peaked mid-pandemic. Retail parks continue to outperform other location types which is perhaps an indication that some of those shopping habits formed during the height of covid are sticking – with consumers favouring these drive-to locations and larger format units. That being said, shopping centres have also seen a relatively significant decline in vacancy rates with investors in some instances seeing an opportunity to convert space into alternative uses to meet the needs of the local catchment, as well as new concepts coming to market and brands returning to expansion. The Christmas trading period seemed to indicate that consumers were favouring, and returning to stores, alongside their online spend. With retail spaces sitting at the centre of our communities hopefully this will support a continued, even if measured decrease in empty units.”

ENDS

Notes for editors

Please contact the LDC Press Office with any additional data or interview requests at press@localdatacompany.com or 07889 591 487.

901

901

901

901