LDC PRESS RELEASE EMBARGOED UNTIL 00:01 THURSDAY 17th MARCH 2022

Analysis released today by the Local Data Company indicates that Britain’s retail and leisure sector is stabilising following the COVID-19 pandemic. The research, which covers the full year of 2021, revealed the first half-year decline in vacancy rate since 2018, suggesting that the worst of the pandemic impact is over. The leisure sector led the way with a record drop of 0.3% in H2 2021.

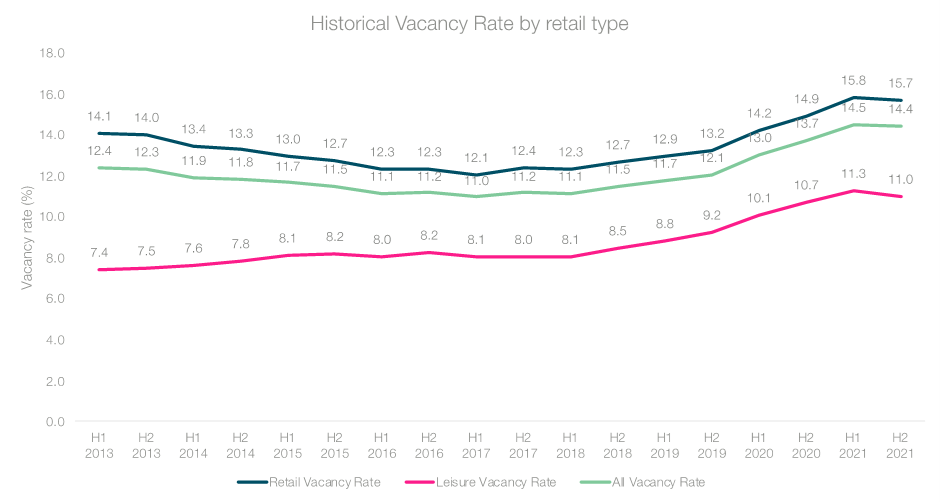

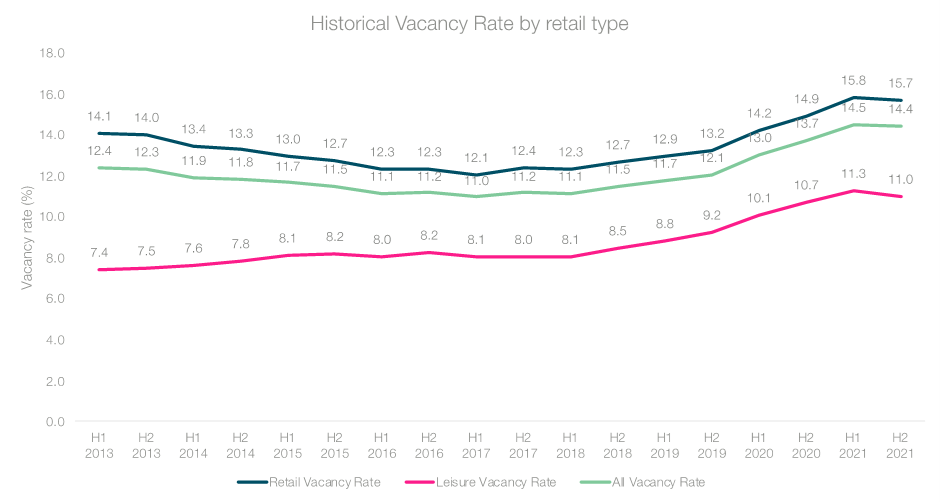

- In H2 2021, the national vacancy rate declined by 0.1% from H1 2021, landing at 14.4% from 14.5% in H1 2021. This is the first decline in the GB vacancy rate since H1 2018, and the clearest indication of the stabilising market. Over the full year, however, national vacancy rate increased by 0.7%, although this figure is still lower than expected given the lack of activity in the first 3 months due to the lockdown.

Figure 1: Historical retail vacancy rates by occupier type across GB, 2013-2021 (Source: Local Data Company)

- The retail vacancy rate hit a record high in 2021, but peaked in the first half of the year at 15.8%, with a 0.1% decrease recorded in H2 2021. The retail vacancy rate now sits at 15.7%. This figure looks set to decline further as more units are taken off the market for repurposing and as retailers return to acquiring new sites.

- The leisure sector shows promising signs of recovery, despite restrictions on hospitality continuing well into 2021. The leisure vacancy rate dropped from 11.3% to 11.0% over 6 months— the largest decrease since records began in H1 2013. Expanding chain and independent F&B operators bolstered growth, while England’s run in the Euros, pent up demand from the various lockdowns, and the return of office workers later in the year provided a further boost to hospitality venues.

- Shopping centres, which had previously seen the greatest increase in vacancy since the onset of the pandemic, saw a reduction in vacancy rate of 0.3%, bringing the shopping centre vacancy figure back down to 19.1% at the end of 2021.

- Retail parks saw a 0.2% decline in vacancy rate in the second half of 2021, continuing the trend of carrying the lowest vacancy rate of any location type since 2013.

- High streets continued to prove more stable than other location types. The vacancy rate for high streets fell by 0.1% in H2 2021. However, high street vacancy rates were only up 2.3% on H2 2019, compared to increases of 3.2% for retail parks and 4.8% for shopping centres over the same period. This suggests that high streets were not as heavily impacted by COVID-19 as the other location types due to being less exposed to at-risk brands and having a higher percentage of independent occupiers who benefited from additional government support throughout the pandemic.

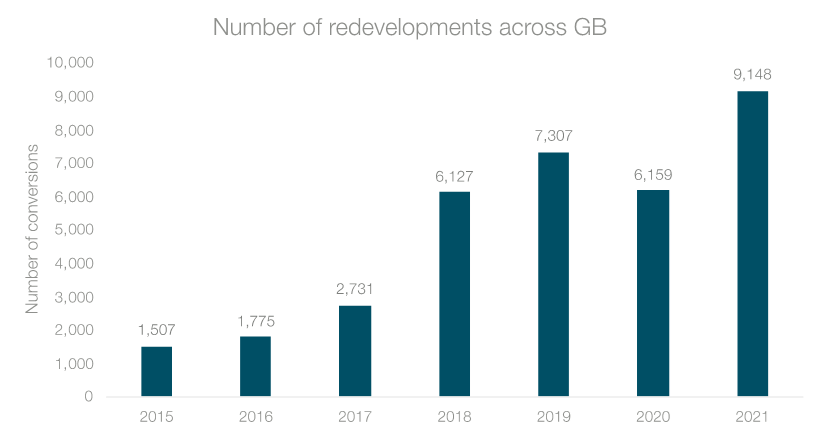

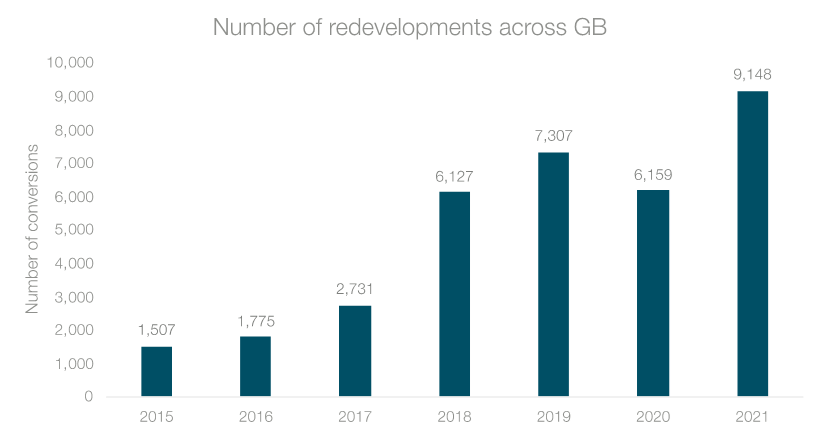

Vacancy rates are not expected to return to pre-pandemic levels yet, but they are projected to decline further over 2022 due to the continued redevelopment and repurposing of retail space; 2021 saw a record jump in redevelopment activity, an increase of 49%, suggesting that the worst of the pandemic-related closures is over and the industry has shifted its focus from survival to recovery.

Figure 2: Redevelopment activity across GB, 2015 - 2021 (Source: Local Data Company)

Commentary from Lucy Stainton, Commercial Director at the Local Data Company

“This latest analysis is significant because the figures finally point to a reversal of the structural decline we had seen accelerate with the onset of the COVID-19 pandemic. Going into this, the physical retail market had already been plagued by a number of other headwinds such as online and digital adoption, but coronavirus brought about long periods of restricted trading and this proved insurmountable for many chains across both retail and hospitality.

"Vacancy rates peaked halfway through 2021 as a result of this but, as we come into 2022, these latest statistics are cause for cautious optimism, with the number of empty shops finally coming down as consumers return to high streets and shopping centres. Our analysis points towards this trend continuing as the final shakeout from various CVAs and insolvencies is hopefully behind us, and independent operators continue to open new sites. With many chains re-looking at their strategy for growth, the independent sector proving buoyant and an unprecedented level of repurposing and redevelopment, we could be seeing the start of a new phase of physical retailing, and we will be tracking this very closely."

ENDS

Notes for editors

Please contact the LDC Press Office with any additional data or interview requests at press@localdatacompany.com or 07889591487.

The full report will be available to download via the LDC website on 17th March. Please visit https://www.localdatacompany.com/retail-and-leisure-analysis-fy-2021 to access a copy or email the Press Office to request an embargoed copy prior to release via the details above.

The full report will include further detail on:

• Openings and closures

• Vacancy rates

• Regional trends

• Multiple vs independent performance

• Growing and declining retail and leisure categories

• Long-term vacancy rates and redevelopment activity

• The impact of home working on office districts

Methodology

The Local Data Company visits over 3,300 towns and cities (retail centres and government-defined retail core), retail parks and shopping centres across England, Scotland and Wales.

Towns are updated on a 6- to 12-month cycle depending on size and churn, with both a field survey and office research team tracking changes in the local market.

Each centre has been physically walked and each premises recorded as vacant, occupied or demolished as recorded on the day of survey. Vacant units are units that did not have a trading business at that premise on the day of survey.

‘Retail’ refers to convenience retail, comparison goods retail and service retail, while ‘leisure’ refers to leisure destinations, namely entertainment venues, restaurants, bars, pubs & clubs, coffee shops and fast food outlets.

The GB vacancy rate analyses the top 650 town centres across England, Wales and Scotland.

H1 refers to the 6 month period of 1st January to 30th June.

H2 refers to the 6 month period of 1st July to 31st December.

About the Local Data Company

The Local Data Company is the UK’s most accurate retail location insight company. We track openings and closures activity for every retail and leisure business across the country. Our data, analytics and insights power strategy and decision-making for businesses working across retail, leisure, out-of-home media, investment, property and financial services.

We employ a team of field researchers who physically audit the occupancy status of every business at frequent intervals, which enables us to capture live information about how the market is changing in real time. The ability to collect such accurate data is strengthened through our proprietary technology stack, developed in-house, which supports our field research and quality control processes. We employ the most innovative development techniques to constantly improve our products and services, be that the core data on over 680,000 businesses, our location insight dashboards or our analytics and consultancy arm.

For more information, please see www.localdatacompany.com

901

901

901

901