Just before we settle down for some well-deserved relaxation over Christmas and New Year, we thought we'd wrap up the year with a recap of some of the biggest retail, leisure and property news stories of 2021, including some of our own insight on major events and trends across the sector.

JANUARY

- 2021 begins in lockdown, as the vaccine rollout gathers pace.

- Online retailer Boohoo acquires the Debenhams brand and website.

- Chancellor Rishi Sunak announces new funding for non-essential retail businesses forced to close during lockdown.

FEBRUARY

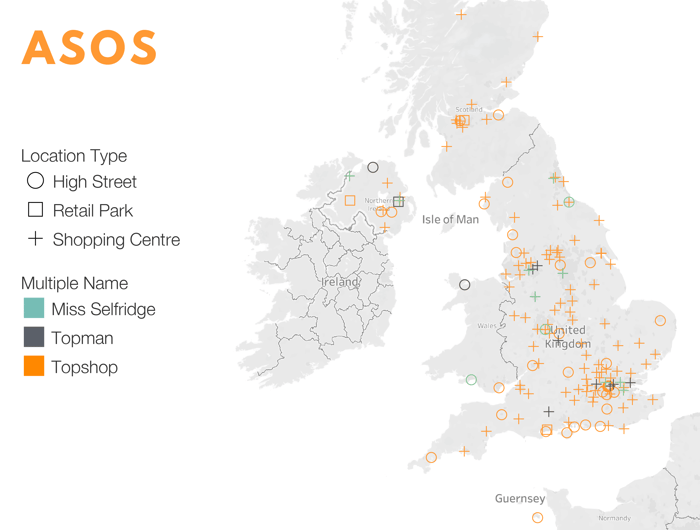

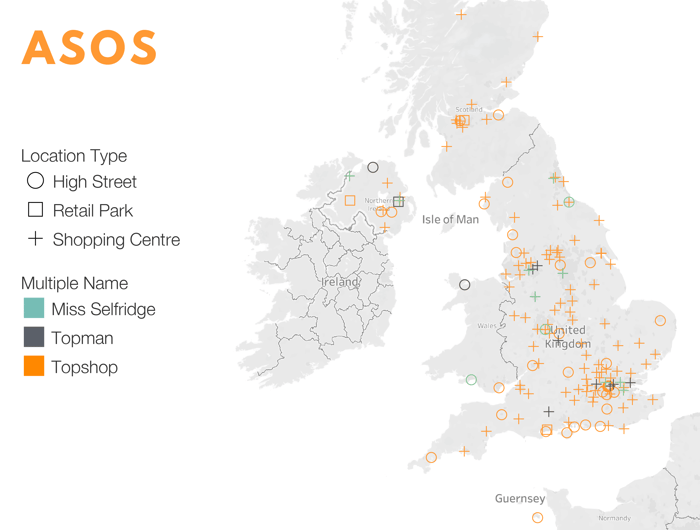

- ASOS acquires the Arcadia brands Topshop, Topman and Miss Selfridge. Boohoo purchases most of the remaining brands.

THE IMPACT OF THE BOOHOO/ASOS ACQUISITIONS ON GB RETAIL LOCATIONS

MARCH

- The Chancellor delivers his first Budget since the pandemic began. Frasers Group owner Mike Ashley warns of store closures nevertheless, calling the announced support package around business rates “near worthless” for large retailers.

APRIL

MAY

- The BBC reports that almost all 50 of the UK's biggest employers do not plan to return staff to the office full-time, but will instead favour a new "hybrid" of in-person and remote work.

- Stage three of lockdown easing goes ahead, allowing larger numbers of people to gather, including at indoor venues.

- West End landlord Shaftesbury has seen a reduction in vacancy rate in the past six weeks, which it hopes will continue.

JUNE

- The Prime Minister announces a four-week delay to ‘Freedom Day’, postponing the final lockdown easing to the 19th July in light of new variants.

- A quarter of Britain’s licensed premises have not reopened yet, despite restrictions on indoor hospitality having been lifted in May.

- UK retail sales saw their highest levels since the start of the pandemic in May. The British Retail Consortium said that sales increased by 10% last month compared with the same month in 2019. The reopening of physical shops and indoor hospitality drove sales growth of more than 100% for clothing retailers.

-

The government extends the commercial rent moratorium until March 2022, in light of the recent decision to postpone the end of coronavirus restrictions by four weeks.

DEMAND AND SUPPLY OF PROPERTY DURING COVID: AN INTERVIEW WITH JAMES RAVEN, CO-FOUNDER OF RAVEN ROSE

JULY

- UK retail sales saw record growth from April to June this year. Compared with the same quarter in 2019, sales increased 10.4%, the biggest jump since 1995, according to the British Retail Consortium in association with KPMG. The increase was attributed to the easing of lockdown restrictions, release of pent-up demand and the Euro 2020 championships.

- British Land says that trading at its out-of-town retail parks has almost reached pre-pandemic levels and rent collection has improved across its portfolio.

- Colliers’ new Midsummer Retail Report indicates that as many as 1 in 3 retail premises in the UK may be ‘zombie shops’, either vacant, not producing income or occupied on a short-term basis only.

AUGUST

-

The number of shuttered stores continues to rise in the UK, according to the latest BRC- Local Data Company Vacancy Monitor.

-

The volume of retail sales dropped 2.5% in July compared with the previous month, according to ONS data.

- Footfall and rent collection have both increased in the West End, according to Shaftesbury.

ONE IN SEVEN SHOPS REMAIN SHUTTERED: THE BRC- LOCAL DATA COMPANY VACANCY MONITOR

SEPTEMBER

- Store visits in the UK rose in August to their highest level since the first lockdown, according to data from the British Retail Consortium and Sensormatic Solutions.

- The growth of online shopping has driven demand for warehouse space across the UK, with nearly 15 million sq ft of ‘super sheds’ built last year. According to real estate advisor Altus Group, a total of 49 new distribution centres were built across the UK, which roughly corresponds with the amount of physical retail space lost due to Arcadia and Debenhams closures.

- 83% of major retailers said they were likely or certain to close stores if no reforms are made to the business rates system, according to research by the British Retail Consortium.

OCTOBER

- Chancellor Rishi Sunak presents his Autumn Budget statement, designed to help the UK emerge from the COVID-19 pandemic. This includes the biggest cut to business rates in over 30 years.

- Landsec has collected 85 per cent of rent owed for the September quarter day, compared to 81 per cent for June.

- The latest ‘back to the office’ data from Springboard suggests that the return to the office has slowed, possibly due to rising Covid-19 cases.

- The UK could run out of warehouse space within a year, according to property agents Cushman and Wakefield.

NOVEMBER

- Online clothing sales are set to overtake in-store sales next year, according to a new report by Retail Economics. Digital purchases increased by £2.7bn, nearly a fifth, during the pandemic.

- Swedish furniture and homeware retailer Ikea buys the former Topshop flagship store on London’s Oxford Street.

- The collection of commercial property rents in the UK has reached the highest level seen during the pandemic. According to Remit Consulting’s latest REMark survey, an average of 81.9% of rents owed by commercial property tenants were collected within 21 days of the due date.

- Black Friday sees a drop in high street footfall for the first time ever on the date.

THE DEBENHAMS REOCCUPATION UPDATE: THE CURRENT STATUS OF THE 160-STORE ESTATE

DECEMBER

- The government rules out further financial support for companies under the latest restrictions, which are set to impact hospitality and retail businesses. Companies can access business rates relief at 66 per cent (up to £2million) until next March, and commercial tenants are still protected from eviction. However, many say this will not be enough to cover predicted losses and disruptions to business.

Continuing coronavirus restrictions and increasing case numbers continue to drive uncertainty across all aspects of life in Great Britain. Over a year of headlines, we've seen openings, closures, acquisitions and partnerships across retail, leisure and property, all arguably driven by the effects of the pandemic. We expect this wave of change to continue, further transforming the face of retail in Britain well into the new year. As always, we will be here to track and interpret these changes.

A Week on the High Street will return in 2022.

901

901

901

901